CHEAT SHEET

- Check the closet for skeletons. Acquiring a company makes human rights a primary responsibility even if the agreement explicitly leaves behind liabilities.

- Divesting isn’t risk-free. Nokia suffered reputational damage when a subsidiary was involved in political repression in Iran, even while they had divested months earlier.

- Tried in the court of public opinion. Acquiring a company with a history of human rights issues, even if legally sound, can generate political and civil society backlash.

- Preventative medicine. Conducting a periodic human rights review of your own business and its subsidiaries lowers the risk that a divestment brings suspect practices to light and raises your company’s value.

Having been both a mergers and acquisitions lawyer and an advisor to John Ruggie, who developed the soft law standard for companies on human rights (embodied in the UN Guiding Principles on Business and Human Rights), I am frequently asked the following question by M&A professionals: What do human rights have to do with us, and how is this different from what we are doing already?

Through acquisitions, companies can inherit the practices of target companies that may in the past have negatively impacted, or continue to impact, workers or communities’ human rights. Through divestitures, sellers run the risk that their divested business be involved in negative impacts on people. Consider Meridian Gold, which acquired Brancote Holdings — the owner of a site in Argentina — for US$320 million. Although legal due diligence did not uncover any issues and the title to land was legal, Meridian Gold ended up with five years of litigation rising to the Argentinian Supreme Court, and lost its entire investment because the surrounding community opposed the use of the land for an open-pit gold mine. Consider Nokia, which suffered a significant hit to its reputation when news broke that its products and services had assisted the Iranian government’s efforts to imprison and harm political dissidents during the 2009 Iranian elections. Nokia had in reality divested the business six months prior to the elections to Iran Telecom, but public opinion was that a company selling a business that can cause significant harm should seek to limit the risk of such harm by incorporating restrictions during the sales transaction or selling to another buyer. Finally, consider American Sugar Refining, which acquired Tate & Lyle Sugars for £211 million in 2010. Subsequent to the transaction, Tate & Lyle Sugars was subject to a £10 million lawsuit in the UK High Court because a sugar supplier in Cambodia had relied on legal title acquired through corrupt practices.

These kinds of human rights risks are on the rise and companies are navigating increasingly unfamiliar waters in this area. Businesses are expanding into new higher-risk markets where legal regimes may not be as protective; increasing populations, inequality, and climate change render workers more vulnerable and access to resources more competitive; and social media enables the public to pass judgment on actions that take place thousands of miles away. These developments can translate into real costs for companies in the form of legal actions, complaints lodged with National Contact Points set up in Organisation for Economic Co-operation and Development (OECD) countries, and investor questioning and divestments. Costs can also include reputational damage from advocacy campaigns, consumer boycotts, operational delays, management distraction, and lost opportunities resulting from conflicts with communities.

Conversely, company experience shows that considering human rights as companies acquire and divest can help companies save money as well as increase the long-term success of the transaction. As investors, governments, consumers, and workers increasingly seek assurance that the companies they invest in, regulate, buy from, and work for are respectful of others, companies are increasingly incentivized not only to run an effective business model, but also to put in place an effective human rights risk management system. This is starting to happen, for instance, by junior oil and gas companies placing stronger emphasis on positive relations with communities surrounding their sites, realizing that a strong social license to operate will positively influence their future valuation.

These human rights risks are leading some companies to start to integrate consideration for human rights into their M&A processes. These companies are working on equipping their M&A teams to identify and address adverse human rights impacts that are connected to the target company or, in the case of a divestiture, that are, or may be, connected to the business being divested. They are working around the challenges inherent to M&A, such as high confidentiality and tight timing constraints, as well as a traditional focus on legal compliance, legal liability, and allocation of business risk.

There is no quick fix for integrating human rights into a company’s M&A processes. Revising due diligence checklists and crafting template representations and warranties alone will not work. As one senior M&A lawyer put it, “These changes are meaningless if M&A lawyers don’t understand what they are looking for and what their role is in the process.” Not only will integrating human rights into a company’s due diligence process entail reviewing additional inputs to due diligence, perhaps more importantly it entails a different way of reviewing information that is already collected, as well as the involvement of others in the business. Indeed, M&A lawyers are but one piece of the puzzle:

- Other professionals in the M&A team also play a crucial supporting role for their companies as business models change through mergers, acquisitions, and divestitures;

- Others in the company, for instance those working in corporate responsibility, sustainability, or procurement, commonly hold valuable information on human rights risks;

- The company’s board of directors and senior management decide on the company’s business strategy, which will include decisions on expansion and divestiture, which carry a certain level of human rights risk; and

- In the case of an acquisition, others in the company will be responsible for the acquired business moving forward, which could include integration to bring the business to the same standards as the buyer.

Little information is publicly available in this area and this article therefore captures insights from the process that is working well for leading companies advancing in this area. Although it is intended primarily for companies and their in-house M&A teams, it will also be relevant for law firms that are increasingly seeking to advise clients in this area, as well as other stakeholders interested in advancing business respect for human rights.

Find relevant examples to build M&A team ownership.

This work will not succeed if the M&A team and the company more broadly is not convinced of the need for it. An effective way of building the M&A team’s ownership of the process is to identify concrete examples of how inadequate attention to human rights may have delayed a transaction, resulted in higher costs, or in the failure altogether of the deal.

A range of examples will exist in the public domain from a company’s sector that the company can seek to draw upon. At the same time, few examples are as powerful as those that come from the company’s own experience. Companies that conduct numerous M&A transactions frequently sit on a treasure trove of relevant examples but these examples are either not widely known in the company or are not seen as connected to human rights. Human rights impacts can range from impacts on workers (e.g., the right to enjoy just and favourable conditions of work, the right to privacy) to impacts on surrounding communities (e.g., the right to an adequate standard of living, the right to freedom of movement). Carefully crafted interviews with M&A professionals can help in identifying examples of successes and failures in how human rights have been managed in past M&A transactions. The following illustrate the kinds of relevant examples in-house M&A professionals have shared with me in the course of these interviews:

- Although our target company was legally compliant with local labor law, we ended up in the press following the transaction for poor labor practices. This was a new country for us and we had relied on local counsel, without realizing the extent to which local labor law fell below international standards;

- We acquired a company (in a water-intensive industry). We calculated that we could afford the cost of water. We realized after the purchase that tensions existed with surrounding communities who felt the company was reducing their access to water. The situation escalated and it was difficult for us to put it right. We found out later that this had been a factor in the target’s choice to sell;

- We acquired a company and started expanding operations. We realized there were many more people living on the acquired site than anticipated, and it would cost us a significant amount to displace them. If we had known before the contract was signed, we could have chosen another site, or passed some of this cost over to the seller;

- We acquired a company and had addressed all the issues we identified during due diligence. A couple of years later, we were surprised to receive a high fine from the government for not providing safe working conditions 10 years prior. Information from the ground to supplement our due diligence on paper might have alerted us to the fact that workers were unhappy about their past treatment;

- We divested a business to a local company with less well-known practices for waste management. We were concerned this could harm the surrounding community and we imposed a number of standards on the buyer as a condition of the sale. It was difficult to impose these standards but we made the case based on our reputation;

- We were able to find out through targeted questions that the factories we were interested in had significant labor issues. The books were in order, but we knew from reading the local news that there were risks inherent to the use of certain labor agencies in this particular country; and

- We were divesting some local businesses and found out that one of the buyers was applying a law to the letter that discriminated against a certain category of our employees. We had managed to find ways to work around this law when operating in this specific country. We were able to have a frank conversation with the buyer and requested that different practices be applied to the workers being transferred over.

Gathering these kinds of internal examples increases understanding of the value to the company of considering human rights in the course of M&A, creates ownership in the M&A team of this process, and provides lessons to build upon.

Determine how the company’s existing processes identify human rights risks and where the gaps are.

M&A teams are already skilled at identifying legal and business risks resulting from a transaction during due diligence. This can include, for instance, risks related to the environment, land, tax, employee relations, compliance, or intellectual property. Any work to identify human rights risks should first ascertain how the company’s processes may already identify human rights risks before suggesting changes to strengthen these processes.

What is different about identifying risks to the business (as in a traditional M&A process) and human rights risks? M&A teams typically use legal and regulatory compliance as a baseline for their due diligence. In light of tight confidentiality and timing constraints, they commonly rely upon information provided by the target company and by third parties such as investment banks and local counsel. They commonly look at contractual relationships. By contrast, seeking to identify human rights risks also seeks to identify issues where local compliance is insufficient. This process seeks to identify actual or potential adverse impacts on internationally recognized human rights and look at the risks from the perspective of those potentially impacted, in addition to the perspective of the business (although the two perspectives increasingly converge). It looks beyond contractual relationships, to relationships used for the business including informal undocumented workers. Identifying these kinds of risks can require looking at the information received differently, requesting additional follow up information from the target company (e.g., on the company's processes for gathering worker complaints or on the community’s experience engaging with communities around its site), and learning from other sources (such as prominent civil society organizations and others in the company with experience in that country). Companies I have worked with typically use a combination of (1) new desktop resources, (2) prior information in the company that is not typically relied upon, such as country or business partner assessments and experience gained from the business on prior transactions, (3) insights from those in the company working on human rights, and (4) additional information from external sources on a no-names basis.

There is an increasing recognition of the distinction between legal liability and the corporate responsibility to respect human rights (which is the standard for human rights conduct under the Guiding Principles): a company may be able to avoid legal liability and yet still be deemed responsible for a negative human rights impact under the Guiding Principles. M&A teams are well equipped to seek to avoid legal liability, but are traditionally not so well equipped to avoid responsibility under the UN Guiding Principles. This matters because, although the UN Guiding Principles are not technically hard law, they are used as the standard of reference to judge a company’s conduct in this area. For instance, they are the standard used for complaints brought against companies at OECD National Contact Points, by investors requesting that their companies account for their human rights practices, in the court of public opinion, and are increasingly referred to in the law and court judgments. Just one recent example is a law being discussed by the French Parliament this year, which would require large French companies to demonstrate how they are implementing the UN Guiding Principles throughout their supply chains.

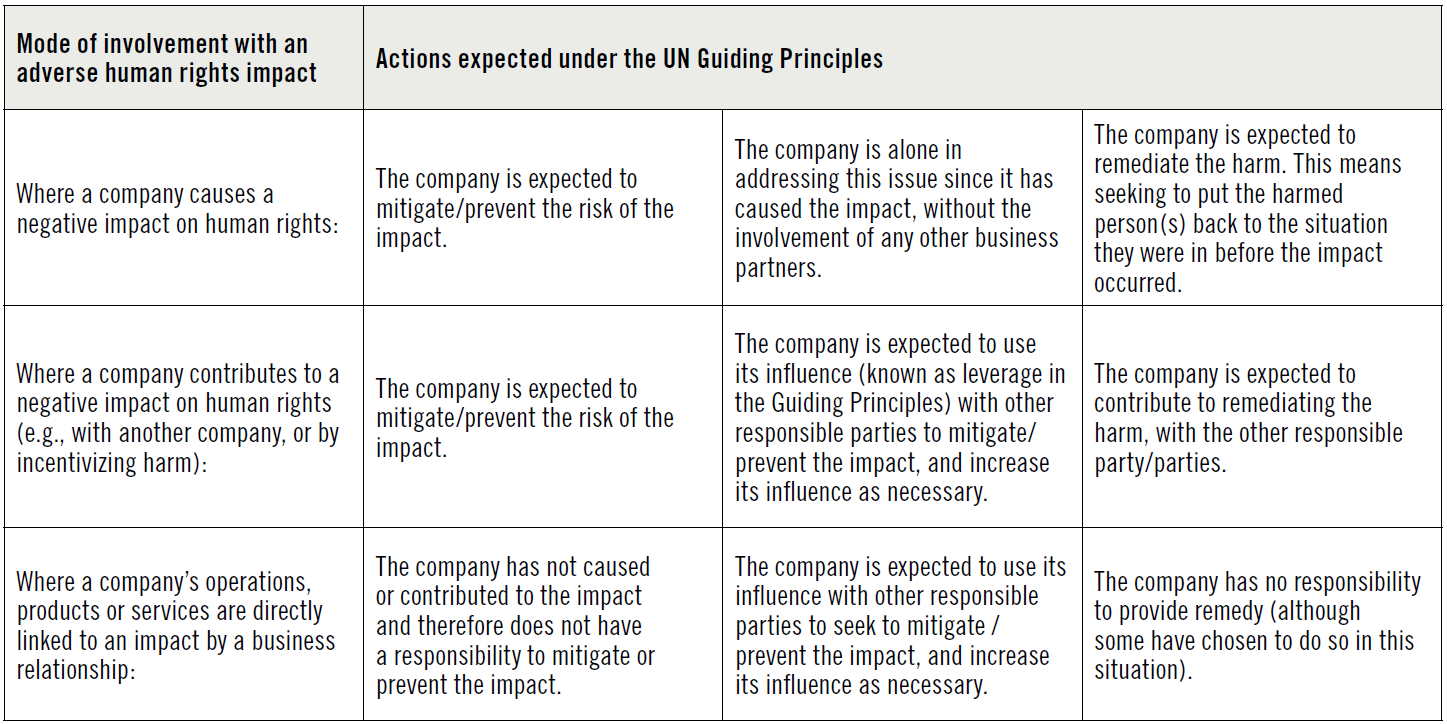

The UN Guiding Principles make clear that companies are expected to respect human rights throughout their operations. To do so, they recommend that companies put policies and processes in place to identify, prevent, mitigate, account for, and remediate their adverse impacts on human rights. They state that a company’s responsibility for human rights depends on how the company is involved with the harm: The company has greater responsibility where it has caused or contributed to a negative impact on human rights than when the negative impact is linked to its operations, products, or services by its business relationships. To illustrate, a company that discriminates against its women workers or changes a supply chain order at the last minute (knowing that this will mean significant overtime for its supply chain workers) has a different responsibility than a company that finds out it has child labor at the end of its supply chain.

What do the UN Guiding Principles’ modes of responsibility mean for the M&A context?

- When one company acquires another, it can inherit human rights issues that the target company has not yet resolved. Even where the acquirer structures the transaction as an asset purchase agreement, carefully leaving the seller’s human rights liabilities behind, in practice the acquirer can still be perceived as taking on the seller’s responsibility for addressing its human rights impacts. Consider the example of The Dow Chemical Company’s acquisition of the Union Carbide Corporation, which carefully sought to exclude the Bhopal plant where thousands were injured and died as result of a 1984 gas release. Although not legally liable, Dow Chemical has widely been viewed, including by the government of India, as responsible for remedying the situation; and

- When a company sells a business, it typically passes its responsibility to respect human rights over to the buyer. Any impacts that the company caused or contributed to and which have not been remedied either should be provided for in the agreement, for instance through an escrow agreement or through tailored provisions, or become the responsibility of the buyer. The seller also should think about the risks of harm occurring in its divested business and consider actions it can take to minimize this harm.

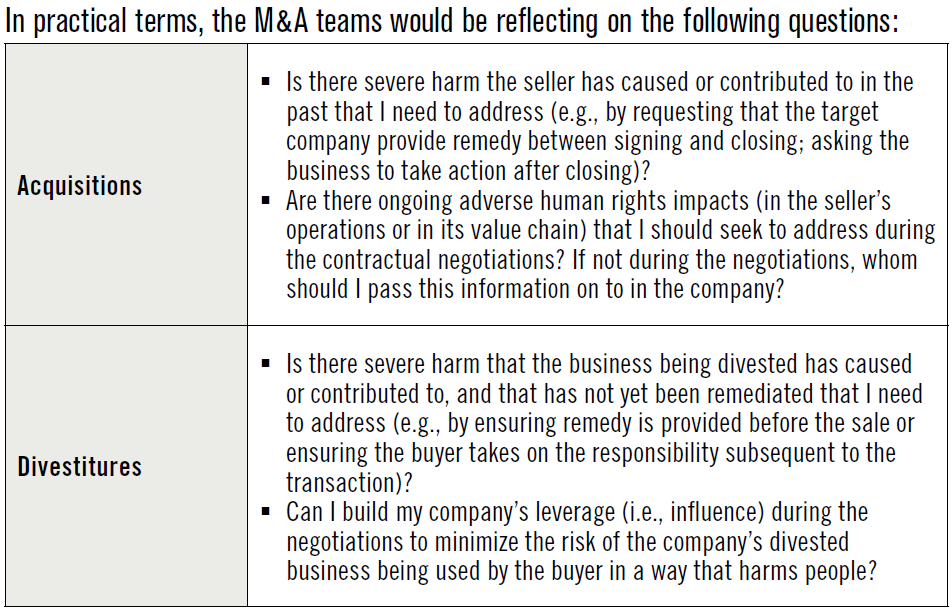

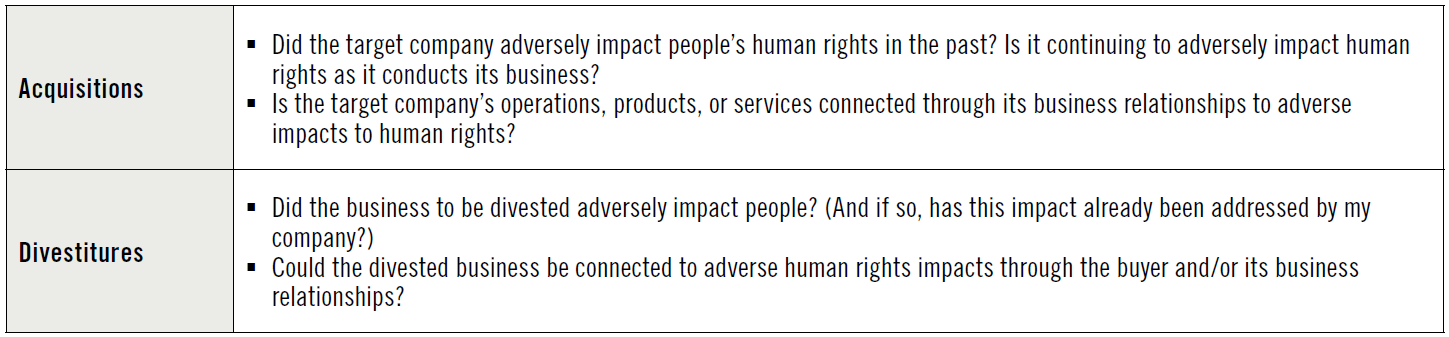

In practical terms, therefore, the M&A teams are looking for answers to the following questions, in addition to their traditional business risk focus:

A mapping of how the company may already be seeking to address these questions will assist in an assessment of where the process may need to be strengthened to adequately capture the human rights-related risks.

Determine a clear allocation of responsibilities within the M&A team for identifying human rights risks.

Companies that are starting to integrate human rights into their M&A processes may initially be inclined to place responsibility for human rights with one individual in the M&A team (e.g., a lawyer, a human resources executive, a corporate social responsibility specialist). However, leading company experience suggests a more nuanced approach that involves collaboration among the whole M&A team as well as others in the business. Although allocation of responsibility will depend on the company’s internal processes (identified through the mapping exercise described below), emerging practice in the risk identification phase for larger companies is to strengthen the M&A process in order to:

- Equip specific functions with the ability to raise human rights-related issues related to their areas of expertise. Each function can play a role in their own specialty in identifying risks to people that may not already be picked up. For example, environmental specialists can consider risks to people resulting from environmental damage, property specialists can consider risks to people resulting from the real estate’s structure, and human resources specialists can consider risks to supply chain workers;

- Equip M&A lawyers with the ability to act as wise counselors by identifying where potential gaps between technical legal risks and human rights risks exist. Increasingly, companies are asking their M&A lawyers to take a holistic view of legal and human rights risks. After all, human rights are defined in international law, and national laws increasingly require business to respect human rights, as regulatory initiatives in France and Switzerland show. This coincides with a movement of lawyers increasingly acting as wise counselors and trusted advisors, in addition to providing technical legal expertise;

- Where it exists, involve in-house human rights expertise in transactions where human rights risks are higher. Some companies have tasked a human rights, sustainability, or corporate social responsibility specialist to support the M&A team in identifying human rights risks. In this case, the process should be structured at the outset to facilitate this function, for instance by providing this specialist access to the data room and the ability to formulate follow-up questions for the target company; and

- Bring in additional external expertise where human rights risks are particularly high or new to the company. To protect the confidentiality of the transaction, the external expertise need not be privy to the specifics of the transaction or can commit to a nondisclosure agreement. For example, the buyer of a mining company operating in areas where indigenous people are living may wish to bring in an independent expert on free, prior, and informed consent. The buyer of a food company that supplies seafood products from Thailand may wish to bring in additional expertise on bonded labor. The buyer of an information and communications technology business operating in a restrictive environment may wish to bring in additional local knowledge on censorship and privacy violations. The buyer of a company that relies heavily on land may wish to solicit expert views on the validity of the titles to land from the local communities’ perspective.

Once responsibility is allocated, the company can work to provide the guidance and tools necessary to assist relevant M&A team members to find and assess the relevant information. Human rights is typically seen as quite foreign to M&A. M&A transactions are typically subject to strict confidentiality and timing constraints and even within one company, the knowledge of the transaction can be restricted to a small number of employees and external advisors. Companies need to equip their M&A teams to navigate these considerations in a way that does not constrain their assessment of human rights risks. Workshops, guidance notes, regular team trainings as well as continued updated information on the human rights risks can all play a role in assisting the M&A team to navigate these, at times, competing tensions.

The kinds of questions that M&A professionals will typically be looking for responses to in this due diligence phase include:

- What are the human rights implications of the information I receive already?

- What additional information may I need from the target company to evaluate human rights risks? For instance, are there questions that are relevant to integrate into the due diligence checklist (related to the company’s approach to human rights risk management and what its salient, or leading, human rights risks are)? Are there follow up questions that are relevant to ask?

- When might I need additional information and where should I go to get it?

- Does the human rights angle change the prioritization of issues to address in the transaction?

Strengthen the company’s M&A process for addressing human rights risks, both during the contractual negotiations as well as after the transaction has taken place.

Once M&A team members are empowered and equipped to identify risks to people in the course of their due diligence, they need to know what to do with the issues identified. Companies starting out in this area have a tendency to focus on strengthening the due diligence phase only. However, considering human rights also affects how issues are prioritized, as well as how they are addressed by the M&A team.

Prioritization of issues to address: In an M&A process, the prioritization of issues to address during the negotiations (the “deal breakers”) is typically based on financial value.

- Bringing a human rights lens to bear adds an additional layer: The areas that have emerged during due diligence as those where people have been, are, or could be, significantly harmed, would also need to be addressed in some shape or form by the company;

- This is not to say that the company necessarily has the responsibility for this significant harm. For instance, the buyer may not be responsible for severe labor violations that are occurring in the target company’s supply chain, but it may seek to push the seller to tackle these violations to avoid becoming directly linked to them;

- Further, this does not mean that the M&A team must address immediately all of the areas that are important from a human rights perspective. For example, a finding that the seller’s security guards have harmed community members may best be addressed during the negotiations in order to ensure that the seller provides or sets aside the funds for remedy. In contrast, a finding that the target company’s buildings are at risk of collapsing may best be addressed after the M&A transaction closes, by relocating the workers to a safer site. In this example, the costs of doing so — breaking the lease, moving the workers, renting a new worksite, etc. — would be relevant for the negotiations since these costs could be factored into the purchase price but the actual actions taken would be taken by the company after the transaction has taken place.

Consideration of human rights can therefore mean a change in how some issues are prioritized for contractual negotiations, and underscores the importance of passing information on to others in the company to address post-transaction.

Addressing the issues identified: In a typical M&A process, assessing the company’s possible legal liability is key, and this will involve the M&A team seeking to allocate risks to the party on the other side of the table. Adding the human rights lens by contrast requires some reflection on the company’s responsibility for human rights (as opposed to legal liability) and some attention to the root cause of the issue. For instance, where workers of a seller were harmed because they were not provided protective equipment, the buyer could seek an adjustment in the purchase price to pay for healthcare and/or compensate those harmed, as opposed to using this money to fight possible workers’ litigation.

As described in above, the UN Guiding Principles distinguish the actions a company should take depending on how it is involved with an adverse human rights impact. For instance, if the M&A team of a buyer company finds that the target company is responsible for ongoing human rights harm, this would technically trigger a different action by the buyer than if the M&A team finds that the company has adverse human rights impacts in its supply chain, which the company is not responsible for.

Conclusion

M&A teams are trained to identify risks and find solutions to them. They play an important role in the company’s ongoing success and viability. The world is changing and companies face increased scrutiny for their human rights practices. By following a process similar to the one described in this article, companies will be better equipped to avoid involvement in human rights harm as their business evolves through mergers, acquisitions, and divestitures.

But M&A teams are not alone in this task. The company more broadly has a responsibility to consider how its business strategy may play a role in increasing its human rights risk profile, and take appropriate action to minimize these risks on an ongoing basis. Seeking to ensure that adverse human rights impacts are prevented as the company conducts its day-to-day business will in turn assist the company if it seeks to divest: a company that addresses its human rights risks on an ongoing basis is likely to command a higher price than one that does not. This is in addition to the other benefits of human rights respect, such as attracting consumer loyalty, long-term investors and motivated employees.

Companies that have sought to integrate consideration for human rights into their M&A processes are now building on this experience by assessing how their other lawyers can play a role in helping the company meet its responsibility to respect human rights. Lawyers in the company who negotiate contracts that are critical to the company’s business, such as procurement contracts, sales contracts, joint venture contracts, and state investment contracts, are equally important in helping the company build and exercise its leverage with its business partners to together advance sustainable and respectful business.