CHEAT SHEET

- Disclosing ESG information. In recent years, investors have demanded more environmental, social, and governance (ESG) information regarding how a company measures and manages its climate-related risks. Consider applying the same vetting and oversight to these disclosures, wherever made, as would be applied to financial disclosures.

- Reporting structures. The international Financial Stability Board’s Task Force on Climate-Related Financial Disclosures released a June 2017 report that established a voluntary framework for assessing and disclosing climate-related risks and opportunities.

- The Rising NGO. In-house counsel should anticipate that NGOs will increasingly compare company disclosures within industry sectors and will take advantage of environmental citizen suit provisions or other mechanisms to draw attention to companies they view as not properly disclosing or managing ESG issues.

- What’s next? Investors have indicated that they like to see companies take a leadership role in identifying that ESG issues are material to the company, and demonstrate how they are measured and managed. Increased transparency through the disclosure process will instill trust in the company’s brand, and create more opportunities for future growth.

In recent years, climate change related risk has become an important topic of discussion in boardrooms across the globe, for companies both large and small. From changes in extreme weather patterns, to the consequences of moving to a low carbon economy, to the impact of new laws and regulations, climate change issues will impact companies regardless of size or location. Whether and how companies assess, measure, and report on these risks — and opportunities — is becoming big business. Dozens of organizations are developing voluntary reporting standards aimed at providing investors with relevant information to enable more accurate comparisons between companies and a better valuation of those risks and opportunities.

The June 2017 release of formal recommendations on climate risk disclosure by the first industry-led Task Force on Climate-Related Financial Disclosures represents an important step that many believe may lead to more uniform — and potentially mandatory — climate risk reporting rules, and should be watched closely by corporate counsel. At the same time, companies are being increasingly inundated with surveys and questionnaires from investors and other nongovernmental organizations (NGOs) regarding how they assess and manage climate risks. NGOs and investors are now scrutinizing statements companies make about climate related risks and sustainability issues. Investors are beginning to give climate risk factors the same weight as financial risks when assessing a company’s performance and prospects.

This article will discuss trends in climate change law and regulations, the important rise of NGOs, and practical advice and case studies to aid corporate counsel in navigating the changing landscape and advising their clients on these important issues. Indeed, in-house counsel have a key role in persuading directors of the importance of adequate disclosure of data and information on environmental risks and their mitigation.

Enterprise exposure to climate-related risks

It is difficult to imagine any business, regardless of size or sector, that can claim to be immune from the impacts of climate change. While fossil fuel companies and energy providers typically grab the headlines when climate change risks are discussed, extreme weather, warming temperatures, and new regulations can impact any business. Companies that depend on predictable climates to grow agricultural products, and depend on agricultural products in their supply chain, are starting to face new risks in a warmer world. Water, a critical input to most industries, may become less available or more costly in some areas. Many companies are increasingly scrutinizing their supply chain risks, with potential consequences to even small suppliers that may not be able to adequately manage their risks. Further, companies with significant greenhouse gas (GHG) emissions may face tighter emission standards, which requires more expensive control technologies. Changing consumer preferences, rising product standards, and the substantial drop in the price for renewable energy can also impact a company’s bottom line. Those enterprises that rely on labor forces in developing countries and elsewhere are experiencing risks from extreme weather events, as well as the human displacement or political instability that follows. The impact of the severe drought in southern Africa in 2015 and 2016 showed the vulnerability of countries with fragile economies and infrastructures dependent on agriculture for overseas earnings and subsistence farming. And more recently, Hurricane Harvey’s catastrophic impact in Houston, Texas, Irma’s on Florida, and Maria’s on Puerto Rico serves as unfortunate and recent reminders that wealthy countries will also suffer harms that could be intensified by a changing climate. Company directors may become more vulnerable to legal challenges alleging they did not adequately measure, disclose, or manage the risks.

Private sector companies are more effectively addressing climate related supply chain risks, developing innovative solutions, and creating substantial investment opportunities. Companies that take a leadership role on these issues with a long-term perspective are likely to be better positioned to prosper and to attract and maintain investors. Corporate counsel can play a valuable role by staying abreast of developments and assisting their clients to better understand the opportunities and thoughtfully manage the risks.

The investor-driven evolution of corporate sustainability disclosures

Assessing and disclosing environmental, social, and governance (ESG) information to the public and investors is not new. Modern ESG disclosure regimes around the world can trace their origins to the environmental movements of the 1970s. Climate risk reporting as a focused topic is more recent, with the US Securities and Exchange Commission issuing guidance in 2010, emphasizing that the traditional test of “materiality” — whether the information is important to a reasonable investor making an investment decision — remains the threshold regarding whether something must be disclosed.

What has changed dramatically in recent years is the number of large institutional investors, financial managers, and shareholders demanding expanded ESG data and information, including how a company assesses and manages its climate related risks in a form that better enables company comparisons and long-term asset valuation to protect portfolios. Another significant development is the number of organizations that have issued voluntary standards that companies can use to bridge the gap between what investors say they need and what companies report. Some companies have started to use the services of sustainability consultants to better identify, measure, and report climate risks. Senior management teams are using the results of these surveys to set targets to mitigate or reduce environmental impacts for its businesses to adopt as part of long-term strategic planning and report to investors, NGOs, and customers on the progress against the targets.

One example of the increased emphasis that investors are putting on long-term climate risk management is the United Nations supported Principles for Responsible Investing (PRI). In 2017, PRI announced it had 1,714 signatures, up from 63 in 2006, and it now represents over US$68 trillion under management. This substantial increase demonstrates that more investors are now directly incorporating ESG information into their investment and ownership decisions.

In 2016, the Sustainability Accounting Standards Board (SASB) issued industry specific, provisional sustainability accounting standards for 79 different industries. For example, SASB’s standards for automobiles include recommended accounting metrics for measuring product safety, labor relations, fuel economy, materials sourcing, and more. SASB’s provisional standards for the agricultural sector identify topics SASB views as material, such as climate change impacts on crop yields, water use, GHG emissions, environmental and social impacts of ingredient supply chains, and management of the legal and regulatory environment. SASB suggests specific metrics for agricultural companies to measure and disclose, including descriptions of short- and long-term strategies to reduce GHG emissions, the amount of water used in areas with high water stress, existing strategies to manage land use, and more. The Climate Disclosure Standards Board, the Carbon Disclosure Project, the Global Reporting Initiative, and others have developed additional disclosure frameworks.

The playing field is so muddled with voluntary standard setting organizations that yet another organization was born, the Corporate Reporting Dialog, with a mission to align the work of the many standard setting organizations and address overlaps. Companies now receive many requests for data and information on ESG topics (from some of these organizations but also from investors), in the form of surveys or other requests. Compiling data and responding to these requests can take substantial time and resources. With so many approaches to disclosure, and so many mediums through which companies report sustainability information (annual reports, sustainability reports, websites, and more), investors have complained that they often have difficulty finding the information they need to adequately assess risk and compare companies. A company’s website and social media postings are now some of the most important tools for reporting on sustainability and are used extensively by investors, customers, and NGOs. The challenge for corporate counsel is to ensure that disclosure via websites and social media on climate related risks is subject to the same rigorous oversight and vetting that apply to financial disclosures and compliance statements.

A company’s website and social media postings are now some of the most important tools for reporting on sustainability and are used extensively by investors, customers, and NGOs.

FSB’s task force on climate related financial disclosures

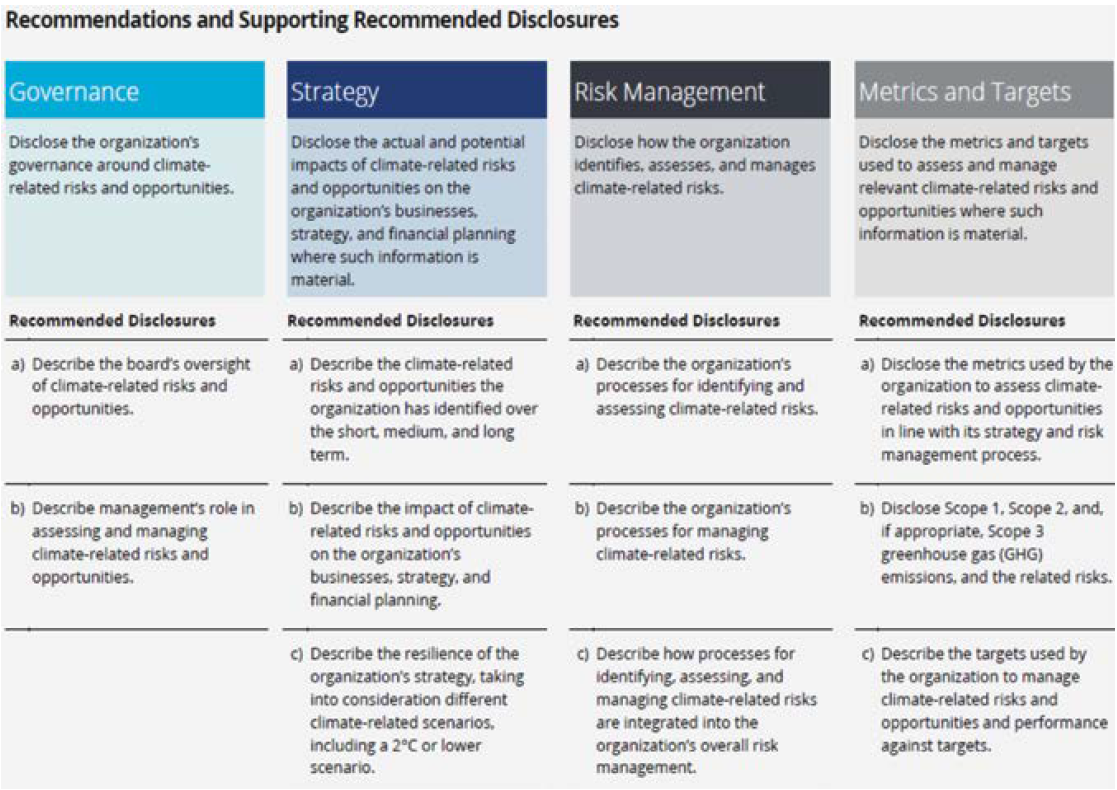

Most recently and much anticipated, the industry-led Task Force on Climate-Related Financial Disclosures (TCFD), a task force established by the international Financial Stability Board (FSB) of the G20 (Group of 20 major economies), issued a final report in June 2017, establishing a framework for assessing and disclosing climate risks and opportunities, as well as guidance for companies to implement the recommendations with a goal to “ensur[ing] that the effects of climate change become routinely considered in business and investment decisions.” The TCFD recommendations focus on four key areas: governance, strategy, risk management, and metrics and targets, and emphasizes a long-term outlook. In the United States in particular, other than major global companies, reporting companies have traditionally been more short-term oriented in their risk reporting, with quarterly financial statements primarily influencing shareholder confidence. Climate risks therefore have not been reported on and managed as long-term material risks as robustly in the United States as they are in Europe. The TCFD report reflects the emerging global shift in this approach to a focus that is more long-term value oriented. Unilever perhaps best exemplified this shift in the European context, when its CEO famously announced it would no longer provide certain quarterly reports or quarterly financial forecasts and would focus on making the right decisions for long-term value, which meant considering climate change, human livelihoods throughout its complex supply chain, and environmental impacts.

Some investors and companies (including major insurance companies) are calling for standardized climate risk assessment and reporting to become mandatory. Many believe that the work of the TCFD will ultimately find its way into regulatory requirements around the world. The US Securities and Exchange Commission (SEC) is currently reviewing comments received in response to a 2016 Concept Release, a general request for comments on whether the current disclosure rules need to be modernized. The Concept Release requested specific comments on whether investors were getting adequate information regarding climate-related risks. Although changes to the federal reporting rules in the United States are not likely in the near term, several of the commenters requested that climate disclosure standards, such as those developed by SASB, be made a mandatory part of the reporting rules (the TCFD recommendations had not been issued at the time of the Concept Release).

The Trump Administration and US climate change action

Despite considerable action being taken to address climate change worldwide, US President Donald Trump announced in June 2017 that the country would withdraw from the Paris Agreement. The US Climate Alliance, a coalition of 14 states representing over 33 percent of the US population and US$7.6 trillion of US GDP, formed in response to Trump’s announcement and has pledged to “pursu[e] aggressive climate action” to work toward the goals of the Paris Agreement. Indeed, many US states are enacting new laws or ratcheting up existing programs to decarbonize their economies, many of which will impact how companies do business in those states.

Several climate initiatives taken before President Trump took office also remain uncertain. A 2014 agreement between the United States and China to reduce GHG emissions remains in effect, but there is not likely to be action at the federal level to meet US commitments. The United States is also a party to the Montreal Protocol, established to address ozone–depleting substances (ODS). In 2016, the international community agreed to amend the Montreal Protocol (the Kigali amendment) to include certain hydroflorocarbons (HFCs) because they have replaced the use of ODS but are potent greenhouse gases. Whether or not the United States will ratify this agreement is unclear. Also in 2016, the United States, Canada, and Mexico agreed to a goal of 50 percent clean power generation by 2025 — another agreement which is now uncertain. The federal Clean Power Plan, the major initiative to meet US commitments under the Paris Agreement, remains stayed by the courts and may be eliminated during Trump’s administration.

President Trump has also rescinded several Obama-era executive actions and rules aimed at climate change. These include rescission of the Council on Environmental Quality’s (CEQs) guidance on how climate change impacts should be considered in environmental impact statements undertaken pursuant to the National Environmental Policy Act (NEPA). NEPA is a US law that requires federal agencies to document and consider the environmental impacts of certain major federal actions.

The current Environmental Protection Agency (EPA) also has announced that it may roll back Obama-era automobile emission standards on 2022-2025 model vehicles, which currently require a 41 percent reduction in tailpipe GHG emissions by fleet. Automakers can only meet these standards by adding electric and hybrid vehicles to the mix, but these can be very difficult to sell in certain areas, and the number sold may not be enough to recover investment costs, especially with low gas prices.

In the United States, the primary greenhouse gases are legally “pollutants” under the federal Clean Air Act, see Massachusetts v. EPA, 549 U.S. 497 (2007). The EPA issued an “endangerment finding” in 2009 as to these greenhouse gases, so the EPA now has a legal mandate to regulate these gases. Because the science supporting the impact of greenhouse gases is so strong, it would be difficult (although not impossible in the current US political climate) for the EPA to reverse the endangerment finding. If the EPA does not act to regulate GHGs, it will likely face increasing litigation from NGOs.

The rising role of NGOs

The election of President Trump and the appointment of Scott Pruitt as the administrator of the EPA led to an unprecedented spike in financial contributions to environmental groups in the United States, many of which have committed to using the courts and state legislatures to fight against what they expect will be the environmental impact of President Trump’s (de-)regulatory agenda. Since President Trump took office, environmental groups have sued the Trump administration over offshore drilling and the EPA’s effort to roll-back regulations aimed at limiting methane emissions from the oil and gas industry. Other NGOs and US states have threatened a lawsuit if EPA pulls back on GHG emission standards for vehicles. Regardless of the outcome on the final rules, litigation by states and NGOs make for uncertainty and present a challenge to industry’s ability to plan.

Corporate counsel should also anticipate that NGOs will increasingly take advantage of citizen suit provisions of environmental and other laws where available, and will draw attention to companies they view as not being respectable corporate citizens around ESG issues.

NGOs are also now compiling and scrutinizing company statements made about ESG issues across a range of forums, and are even comparing and ranking companies based on their corporate responsibility and disclosure of ESG risks and opportunities. This is increasingly evident in the climate change context. Groups like Ceres, and most recently Envonet.com, compile company disclosures on environmental and climate risks and make it simple to do “side-by-side comparisons” of various companies. In many ways, we are entering the age of big data for ESG risk disclosure, raising important considerations for corporate counsel.

Reputational risks around climate, environmental, and social issues should be an important concern of corporate counsel. Even the best corporate actors can have their statements and actions misinterpreted, and no company wants its name negatively portrayed in headlines. Preventing inadvertent discrepancies in ESG disclosures that could lead to undeserved reputational damage is far easier than responding to NGO claims that a company is doing harm, or is not living up to the statements and the values reflected in various disclosures.

Companies can also partner with NGOs to drive innovation and solutions to ESG issues that benefit both the corporation and the NGO. A recent example is the Midwest Row Crop Collaborative, a US coalition that includes Kellogg’s, Monsanto, Environmental Defense Fund, The Nature Conservancy, and others partnering to “support farmers in the improvement of soil health and water quality.” Effective collaborations with NGOs can enhance company reputation, business and sustainability goals, and bring fresh ideas to both organizations.

In the agricultural sector, large producers have seen increasing pressure from NGOs and customers to implement higher environmental and social standards in their operations, particularly in developing countries where pressures on land and water resources are acute. Producers are developing and adopting new technologies to lessen environmental impacts and deal with more unpredictable weather patterns. Some of the larger producers have introduced programs to help smaller farmers benefit from new techniques that reduce environmental impact, improve crop yield and quality, and command higher prices. The large producers will buy the crop from these out-growers at a fair price, thereby helping to ensure an income stream for poorer communities.

Reputational risks around climate, environmental, and social issues should be an important concern of corporate counsel.

Case study: Internal combustion bans

In the automobile industry worldwide, current and future regulation of GHGs from tailpipe emissions is by far the largest “materiality” factor regarding ESG disclosures. Several countries, including the United Kingdom, France, and China (the largest single automobile market in the world), and the US state of California, have announced plans to severely limit or entirely ban new vehicles powered by internal combustion engines (ICEs) in the near future, likely within about two decades. Regulations currently in place in the United States require that automakers reduce GHGs in tailpipe emissions by approximately 50 percent in the next 15-20 years, which in turn reflects a 50 percent increase in fuel economy in ICE vehicles. The GHG reductions required by 2025, if achieved solely through fuel efficiency improvements, are equal to a fuel efficiency standard of 54.5 miles-per-gallon on a fleet-wide average. A government progress report issued in 2016 found this goal to be unrealistic because it reflected a larger consumer shift away from trucks and SUVs to standard cars than is actually occurring (or likely to occur) in the marketplace. To meet these increasingly demanding GHG and fuel efficiency requirements in the United States and around the world, all major, full-line automakers have already begun to “electrify” their fleets; however, current technology does not meet the full range of consumer needs or demand. Just how the automobile sector will manage this future regulatory risk, while bringing the technology along so as to meet current and prospective consumer demand (if possible), should be a main topic in ESG disclosures for the foreseeable future.

Case study: Sierra Club v. Federal Energy Regulatory Commission

In 2017 US President Trump directed the Council on Environmental Quality to rescind its guidance on how climate change impacts should be considered under the National Environmental Policy Act (NEPA) for certain major federal actions. Because courts continue to interpret NEPA as requiring consideration of climate change impacts, a lack of guidance regarding how agencies are to consider climate impacts may cause confusion and the potential to delay major infrastructure or other large projects if NGOs challenge the adequacy of climate impacts discussed in environmental impact statements. In August 2017, the US Court of Appeals for the District of Columbia Circuit, in

Sierra Club v. Federal Energy Regulatory Commission, ruled that the NEPA environmental impact statement for a federally permitted pipeline project was defective because it should have quantitatively estimated the project’s GHG emissions, including the emissions from the ultimate burning of the fossil fuel downstream. The court vacated the federal authorization for the pipeline

and remanded for the preparation of a new environmental impact statement.

State enforcement, big data, and the securities laws

In response to the lack of federal action on climate change in the United States, state attorneys general (AGs) formed a coalition and have initiated criminal and civil investigations into major companies, using the power of the subpoena or civil investigative demand to obtain information about what a company may have said internally about climate risks. The New York AG has taken a prominent role in these investigations using a broad New York State anti-fraud law, and has obtained settlements requiring specific climate risk disclosures be made in future SEC filings (raising important legal issues regarding the power of a state attorney general to mandate what statements must be made in filings submitted pursuant to a federal regulatory regime). Whether the attorney general’s actions are appropriate or prudent is beyond the scope of this article; regardless, corporate counsel must take their existence into account in advising their client companies.

The subpoenas issued to these companies often required internal documents and statements made by the companies about climate change going back as many as 40 years. Litigation over the legality of these investigations and the veracity of the accusations made against the companies are still playing out in the courts in the United States and are costing substantial company resources to defend. Currently, charges regarding inadequate disclosure of climate risks are being primarily directed to fossil fuel companies; however, some analysts believe this will be expanded to other industries such as energy providers or other GHG intensive industries, such as cement, steel, mining, or more.

As more and more data from company disclosures is being culled, compiled, and analyzed by shareholders, investors, and NGOs, the potential for shareholder derivative suits, state investigations, and reputational damage increases. For example, the Financial Accounting Standards Board (FASB)’s Accounting Standard Codification Topic 450-20 (ASC 450) (formerly known as Statements of Financial Accounting Standards No.5 (FAS 5)), governs loss contingencies and requires that companies disclose certain “contingent liabilities.” FASB’s Interpretation No. 47 (FIN 47), Accounting for Conditional Asset Retirement Obligations, provides guidance on recognizing liabilities where legal obligations to retire assets may be conditioned on an uncertain future event. There is no specific guidance within ASC 450-20 or FIN-47 regarding accounting for potential losses due to climate-related circumstances, but there is already speculation that some public companies may be underreporting the loss contingencies and asset retirements that are likely to be associated with climate change. Corporate counsel should be prepared for these types of financial disclosures to be compared with its competitor’s disclosures.

Companies should also be aware of the potential for liability under Section 18(a) of the 1934 Act and SEC Rule 10b-5. Section 18(a) is a relatively infrequently invoked provision that provides a private cause of action to a person who purchases or sells a security in actual reliance on a materially false or misleading statement made in certain documents filed with the SEC where the misleading statements affected the security’s price, 15 U.S.C. §78r(a). In part because Section 18 does not require a showing of any intent to deceive, it is possible that this section may be tested in the climate risk disclosure context —in particular by institutional investors. Acting in good faith, without knowledge that the statement was false or misleading, is an affirmative defense to a §78r(a) claim. The content of disclosures made outside SEC filings could therefore become relevant in efforts to avoid §18 liability.

SEC Rule 10b-5 also provides liability for material misstatements or omissions in securities transactions made with intent if relied on by the plaintiff. Voluntarily disclosures and statements made in SEC filings should be consistent to avoid the possibility of 10b-5 liability. Importantly, Rule 10b-5 governs fraud in any securities transaction, even if the issuer is a private company. Climate risk disclosure presents a unique and potentially difficult challenge to strike the right balance between highlighting climate change opportunities and identifying material risks, while avoiding misleading statements or omissions.

Moving forward

Most companies value social responsibility and environmental sustainability and are taking affirmative action to become more sustainable in the long term. As the old saying goes, “what you measure matters, and you cannot manage what you don’t measure.” Companies can benefit from better understanding whether and how sustainability accounting standards would benefit their company and what other companies in similar sectors are measuring and disclosing. Many companies are already realizing the improved performance and risk reduction that comes with measuring and reporting on ESG issues.

Most companies value social responsibility and environmental sustainability and are taking affirmative action to become more sustainable in the long term. As the old saying goes, “what you measure matters, and you cannot manage what you don’t measure.”

Climate change is an area where the separation between financial and non-financial assessments of material risk and opportunities is not always clear. The risks associated with climate change are also relative, and must be weighed against other risks or opportunities facing a company. Increased transparency around these issues is being called for by investors and NGOs and is valued by customers.

Some investors have indicated they would like to see companies take more of a leadership role on identifying what ESG issues are material to the company, demonstrating how they are measured and managed, and linking them to financial performance rather than general statements regarding risk or opportunity that are often found in sustainability reports and in the MD&A (Management Discussion and Analysis) section of SEC filings. Finding the right metrics and valuing them can be extremely challenging in the ESG context. The Financial Stability Board’s TCFD recommendations may serve as an important resource in this regard.

Managing climate risk analysis and disclosure is more than just accounting for or trying to reduce carbon emissions; it is a comprehensive long-term strategy to accurately values assets and understand how the enterprise, and those it relies on in its supply chain, will fare (or how it will gain a competitive advantage) in a warmer, carbon constrained world. The future is likely to bring increased rules, regulations, and policies regarding climate change and ESG reporting issues. Corporate counsel can best serve their clients by staying involved, commenting on and leading the development of any new rules, and understanding where legal risks and opportunities exist

Five steps to advising your CEO and BOD on climate change related risks and opportunities

- Establish a process to vet climate-related statements made on company websites or through social medial platforms as thoroughly as the company would vet financial related disclosures.

- Identify and monitor what climate related risks and opportunities your company’s peers are disclosing, and where they are disclosing this information. Be prepared for investors, NGOs, and others to compare your disclosures to your competitors.

- Review the climate risk disclosure framework recommended by the Financial Stability Board’s Task Force on Climate Related Financial Disclosures and determine if adopting any of the recommendations would benefit the company and increase its long term competitiveness. The final report is available here.

- Consider using the services of sustainability consultants to better identify, measure, and report climate risks and opportunities. Senior management teams could use the results of these surveys to set targets to mitigate or reduce environmental impacts as part of long-term strategic planning and reports to investors, NGOs, and customers on the progress against the targets.

- Consider obtaining advice on selecting a suitable method and format of reporting that is relatively transparent and recognizable.