Savvy litigation managers know that effective management is first and foremost about strategy. The strategy you employ early and execute consistently throughout a lawsuit can mean the difference between winning and losing. Similarly, the strategy you employ to manage your litigation portfolio can increase the likelihood of having satisfied stakeholders and sound fiscal management. Below are checkpoints every litigation manager can use in an arsenal of successful strategies.

1. Understand your stakeholders

Litigation in an organization generally doesn’t happen in a vacuum solely occupied by the legal department. Depending on the nature of the case and size of risk, there may be multiple stakeholders keenly interested in the prognosis, progression, and outcome of any particular lawsuit.

Develop or review your list of stakeholders, updating it to reflect pending or anticipated litigation. Periodically update stakeholders’ needs.

Effective stakeholder communication typically requires customization to your audience, such as:

- The CEO may want a full report of all litigation updated monthly, with a focus on cases posing the highest risk to the company;

- The CFO may want a quarterly report of all litigation, with high risk and high exposure litigation reported more frequently along with respective financials;

- Internal auditors and company insurers may require an update of only the material litigation once or twice a year; or

- Your financial business partner may need litigation budgets on an aggregate or case-by-case basis with ongoing reporting on the actual versus budgeted monthly spend.

Even if you have these processes in place, checking in with stakeholders to refine or update their needs as litigation evolves — or at the start of the calendar or fiscal year — can instill confidence in the law department’s handling of the organization’s legal risk and litigation portfolio.

2. Proactively partner with outside counsel

Your outside counsel are your trusted partners; leverage their expertise to assist in the development of sound strategies for each lawsuit. Remember, however, that they will lean toward protecting you at every turn, so being transparent about your desired end game can ensure alignment. For example, in a low-risk matter, you may not want counsel to file an expensive motion you will likely lose just to protect the record for appeal when you already know you won’t appeal.

Comprehensive outside counsel guidelines are foundational to setting expectations for how you will interact with your outside counsel and cohesively manage your litigation.

- Have you read your guidelines lately?

- Do they still accurately reflect your needs?

- When was the last time you updated them?

Review and update your outside counsel guidelines at least annually.

Having great guidelines is useless if they are not properly implemented. Remind your law firm relationship partner to ensure that everyone working on your matters is familiar with the guidelines. In tandem, establish and communicate consistent rules for how noncompliant invoices will be handled.

Billing and matter management systems (e.g., Onit, Serengeti, SimpleLegal, and TyMetrix) are helpful in streamlining the work required to review and approve outside counsel invoices. If you do not have a matter management system, depending on the size of your litigation portfolio, the investment may be well worth the time, pain, and cost of establishing one.

Metrics such as Full-time Equivalent (FTE) hours spent on billing administration before and after the installation of your matter management system is one way to demonstrate value and savings.

3. Understand your litigation portfolio

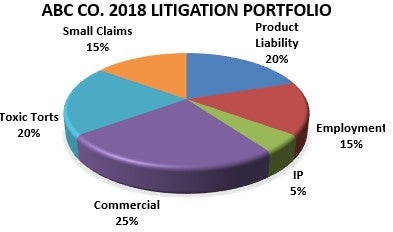

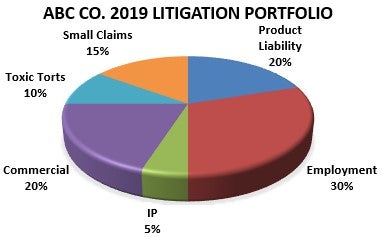

Taking a high-level view of your litigation portfolio can shed light on litigation trends and help to predict potential exposure. For example, if your litigation footprint has shifted as below in the past two years, the doubling of employment law cases may prompt examination of the underlying contributing factors.

Perhaps an acquisition or layoffs account for the spike in employee claims. If the claims are concentrated in a particular location, it might indicate problems with the management of that particular facility. You can develop metrics to monitor litigation by company footprint, business unit, or any other relevant quantification.

Having an aggregate view of your litigation portfolio enables you to trigger proactive conversations and develop strategies to reduce exposure.

4. Assess your potential exposure

Many C-suite executives are maniacal about identifying, assessing, and mitigating risk. As ground zero for management of many of the company’s critical risks, the legal function tends to receive more than its fair share of scrutiny. A significant factor in effectively managing your litigation portfolio is understanding the company’s potential exposure in every litigated matter. There are multiple ways to evaluate risks, including:

- Historic experience with similar matters;

- Third-party benchmarking and risk reports on everything from corruption to physical structures;

- Your company’s own insurance underwriting reports; and

- The experiences of your peers in similar or other industries.

Consider developing an easy way to aggregate potential exposure to enable concentrated focus on cases threatening the highest potential risk. For example, you can employ a simple checklist for your litigation that pegs the risk of each case as follows:

- High risk: >US$500,000 in potential settlement or judgment cost

- Medium risk: US$25,000-$50,000

- Low risk: < US$25,000

This indicator can be incorporated into stakeholder reports, placing the cases with the highest risk upfront to garner immediate attention and avoid spending unnecessary time on lower risk cases easily handled without stakeholder input.

5. Effectively manage your budgets

To many lawyers, managing litigation budgets feels like wrestling an octopus. Unpredictability lurks in every case and yet your finance and businesspeople may have never met a metric they didn’t like, and they expect you to compose a solid budget with minimal variances. They may also expect per-matter lookback metrics such as the chart below, which compares the amount of damages each plaintiff demanded to the actual settlement or judgment amount.

Your finance team may prove helpful in developing charts and graphs you can use to track monthly actual-to-budget spend. Also, your outside counsel’s flat fee and alternate fee arrangements may be more efficient than the traditional standard hourly billing models. Leverage these whenever possible to smooth the monthly variances in your litigation spend.

Begin as you mean to go on; don’t start the year with a roster of glamorous metrics that dwindle each month as you get busy or tired.

Parting thoughts

Litigation can be exciting yet stressful. Taking a strategic approach to both the individual cases and the aggregate litigation portfolio is more likely to mitigate risk, effectively manage stakeholder expectations, and maintain your own sanity.