Banner artwork by Association of Corporate Counsel

The Association of Corporate Counsel has long advocated for chief legal officers to have a seat at the table. ACC strongly encourages the best practice of having the CLO report directly to the company’s chief executive officer and have direct access to the company’s board of directors.

Having the general counsel or CLO as a direct report to the CEO ensures that the general counsel is at the executive table when business strategy is formed, confirming that legal risk and compliance perspectives are reflected in that strategy. The general counsel is uniquely suited to guide the company in these important areas, as other C-suite executives lack the legal expertise needed to proactively and holistically address these challenges. Additionally, the general counsel is the board's natural ally in maintaining appropriate risk and compliance controls, but that requires a consistent relationship with the board of directors.

ACC’s annual Chief Legal Officers Survey has tracked the percentage of CLOs that report directly to the CEO and have had a direct reporting line to the company’s board of directors for six years. Although our data suggest that these best practices have not been universally adopted by companies, there has recently been a significant leap forward in the number of CLOs that report to the CEO and those that have a boardroom presence.

This article takes a detailed look at the CLO Survey results by analyzing varied results along geographic lines and examining the differences between CLOs that report directly to the CEO and those who do not.

Based on the CLO Survey data, CLOs who report to the CEO are more frequently involved in critical business decision-making settings. The percentage of CLOs who report to the CEO and have boardroom presence varies significantly by region. Although the reasons behind this variation are unclear, it is ACC’s goal as a global organization to advocate for this practice to be the global standard for corporations. By having a seat at the table, CLOs are true business leaders and their responsibilities and influence go far beyond that of the company’s top lawyer.

Although our data suggest that these best practices have not been universally adopted by companies, there has recently been a significant leap forward in the number of CLOs that report to the CEO and those that have a boardroom presence.

Significant geographic variation exists among CLOs reporting to the CEO

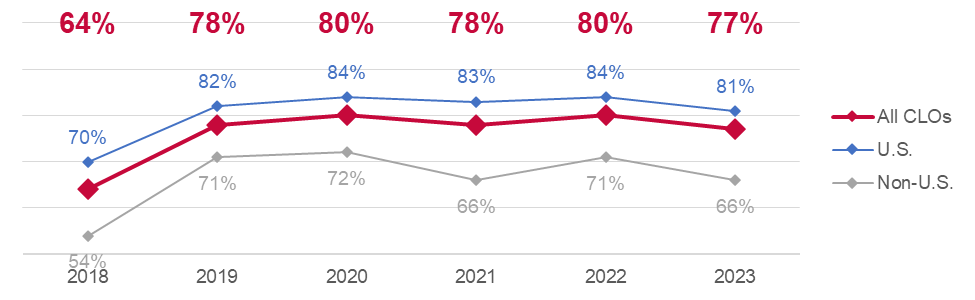

The ACC Chief Legal Officers Survey monitors the percentage of CLOs that report directly to the CEO or the top executive in the organization. In recent years, this number has stabilized at around 80 percent of CLOs globally reporting directly to the CEO, a significant uptick from 64 percent in 2018.

However, the survey results consistently show that substantial regional differences exist. While CLOs in the United States report to their company’s CEO in more than 80 percent of cases since 2019, that number is about 10 to 15 points lower for survey participants in other countries. In 2023, just two-thirds of CLOs in countries other than the United States report to the CEO compared to 81 percent of US-based participants.

Percentage of CLOs reporting directly to the CEO, 2018-2023

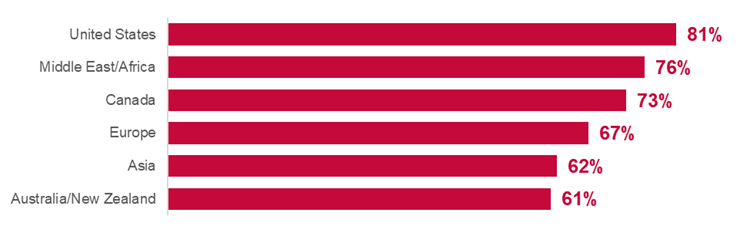

When looking at the results more granularly by global region, the differences are even more remarkable. Following the results in the United States, 76 percent of CLOs in the Middle East and Africa report to the CEO directly, and 73 percent of Canadian CLOs do so as well. Europe-based participants are right on the global, non-US average with two-thirds reporting directly to the CEO, while just about 6 in 10 participants in Asia and Australia/New Zealand responded that they report directly to their company’s top executive officer. Only 11 participants in the survey were located in the Latin America and Caribbean region, and the results for that region are excluded from the charts that follow.

Percentage of CLOs reporting directly to the CEO by region

These differences reflect the distinctive corporate cultures and positioning of the CLO and the in-house legal function that exist across global regions. This variation is also noticeable in the other key metric that ACC tracks related to the CLO’s involvement in the organization’s board of directors.

CLOs presence in the boardroom is growing, but regional differences remain

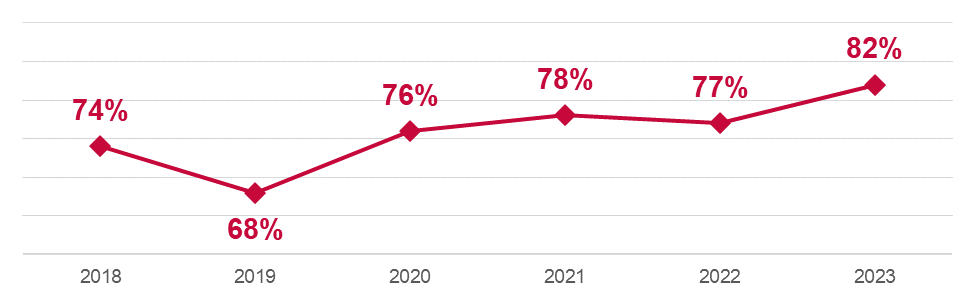

The CLO survey asks how often respondents are involved in certain scenarios related to corporate governance and strategic decision-making. Participants can say that they are never, seldom, often, or almost always involved in these situations. In recent years, the number of CLOs that almost always attend board meetings has grown to a record 82 percent recorded in this year’s survey.

The CLO’s presence in the board of directors’ meetings is critical to provide the legal department a direct say in corporate governance and influence decision-making from the perspective of regulatory compliance, risk management, and ethics.

Percentage of CLOs with consistent boardroom presence, 2018-2023

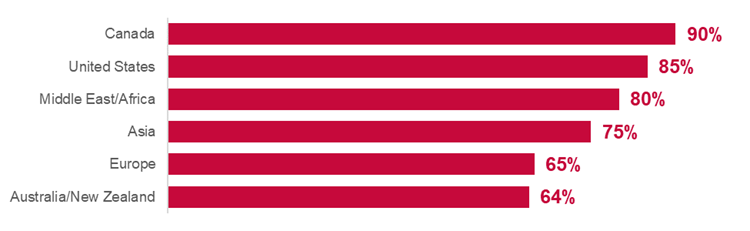

However, the participation of CLOs in the board of directors’ meetings is also uneven across global regions. While a large majority of CLOs in Canada (90 percent), the US (85 percent), and the Middle East (80 percent) have a constant presence in the boardroom, CLOs in Asia (75 percent), especially in Europe (65 percent), Australia and New Zealand (64 percent), regularly attend board meetings in fewer numbers.

The silver lining is that most CLOs globally are almost always present in board meetings, but the differences between regions are substantial and signal that CLOs in companies in Europe and Asia-Pacific, especially, may have a more limited say in corporate governance and in business strategy than their counterparts in North America.

Percentage of CLOs with consistent boardroom presence by region

Having a "Seat at the Table' is critical for influencing corporate strategy

CLOs that report directly to the CEO are more involved in corporate governance and strategic decision-making. It is critical to have the legal department’s input at the highest level to make sure that organizational strategy is always informed by the compliance, ethical, and regulatory requirements that determine business operations.

The CLO Survey results clearly show that there are dramatic differences in terms of access level and influence on corporate policy between CLOs that report directly to the CEO and those who do not.

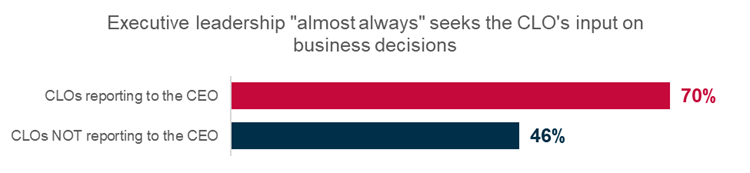

When asked about how often CLOs are consulted about business decisions by corporate executive leaders, 70 percent of those who report directly to the CEO said they are “almost always” consulted compared to just 46 percent of those who do not report directly to the CEO. This is a substantial difference, and it means that when CLOs do not have a seat at the table the company leadership may make important decisions on business matters without the input of the legal department.

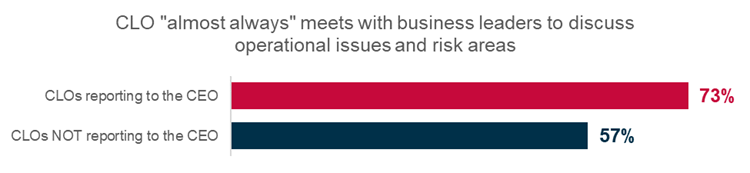

When it comes to discussing operational issues and risk areas, 57 percent of CLOs that do not report to the CEO say that they “almost always” are consulted on these topics. This percentage is higher than those consulted on business decisions, but much lower than the 73 percent of CLOs who report directly to the CEO and regularly weigh in on discussions related to operational issues and risk areas.

CLO’s influence on the business based on reporting structure

Survey participants emphasized in open-ended comments that, for CLOs, being a good lawyer is a given, but the job also requires the CLO to become a true business leader by learning and understanding the company’s business, building relationships across people and functions, and serving as a trusted advisor on both legal and non-legal issues.

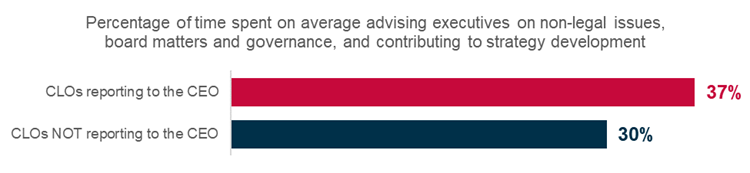

CLOs that report directly to the CEO tend to spend more of their time at work on corporate governance and influencing business decisions than those who do not report to the CEO. The bulk of the job still revolves around legal matters, with practically all CLOs dedicating most of their time to providing legal advice, managing legal risk, and managing the law department.

However, CLOs that report directly to the CEO spend more time on average advising executives on non-legal issues, contributing to business strategy, and handling board matters and corporate governance. On average, CLOs that report to the CEO allocate 37 percent of their time to these non-legal activities compared to just 30 percent of the time for CLOs that do not report directly to the CEO.

CLO’s average time at work spent on business strategy and governance

The results indicate that reporting to the CEO enables CLOs to play a larger role in advising on business matters beyond their core legal responsibilities. Because these CLOs are more involved in business planning, these organizations have the benefit of legal analysis at the outset, increasing the odds for more favorable compliance and risk management outcomes.

We are on the right track, but there still is room for improvement

ACC advocates for the proper role and positioning of the general counsel to be a wider topic of discussion. Although more CLOs have a seat at the table today than five years ago, large regional differences remain and there is still room for improvement. ACC’s goal is for 100 percent of CLOs globally to report directly to the CEO and have a presence in the board of directors.

There remain several unknowns in understanding why there are significant geographic variations concerning the CLO’s direct reporting to the CEO. One possible explanation may be the lack of legal professional privilege for in-house counsel in some jurisdictions. When CLOs cannot ensure their conversations are protected, or in jurisdictions where they must leave the bar organization to enter in-house practice, businesses may not view the CLO with the same lens that jurisdictions that recognize the in-house lawyer as equivalent to a lawyer in private practice. As this article suggests, organizations have much to gain when the CLO is intimately involved in all aspects of the business.

ACC'S goal is for 100 percent of CLOs globally to report directly to the CEO and have a presence in the board of directors.

The absence of the CLO’s voice in the C-suite or the boardroom works against the best interest of investors and other stakeholders, as legal and compliance risks are too significant to sideline. The CLO Survey results show that CLOs that report directly to the CEO are more likely to regularly engage with other business leaders and thus have higher influence in the company’s decision-making processes. ACC encourages boards, institutional investors, CEOs, regulators, and the judiciary to support this as a matter of corporate governance and set the right "tone from the top" on corporate culture.

Disclaimer: The information in any resource in this website should not be construed as legal advice or as a legal opinion on specific facts, and should not be considered representing the views of its authors, its sponsors, and/or ACC. These resources are not intended as a definitive statement on the subject addressed. Rather, they are intended to serve as a tool providing practical guidance and references for the busy in-house practitioner and other readers.