United States (US) companies with operations in the European Union (EU) need to know about a new mandatory information reporting regime in the EU affecting post-June 25, 2018 transactions in order to track those transactions potentially subject to this new requirement. The transaction reporting requirement issued under EU Directive 2018/822/EU has the goal of providing early access for tax authorities to information about tax planning and sharing of that information among Member States. The Directive is dubbed “DAC6” because it is the sixth iteration of the Directive on Administrative Cooperation (originally Directive 2011/16/EU). It requires additional exchanges of information for cross-border arrangements that meet certain hallmarks or characteristics and may apply to ordinary business transactions.

Under DAC6, intermediaries of a company that engages in what the Directive terms a cross-border arrangement that meets at least one pre-determined hallmark will be required to report the transaction to the tax authority of the appropriate Member State. In some cases, the company itself may be required to report such arrangements. Each Member State will automatically exchange and communicate the information to the competent authorities of all other Member States through a centralized database. From the database, Member States will be able to access all reported arrangements involving a taxpayer across all EU jurisdictions. This information, reported by intermediaries rather than the taxpayers themselves, may be used by tax authorities to plan future audits.

As a mandatory reporting regime, failure to properly report under the Directive may trigger penalties, the amount of which will be determined by each Member State individually. Because intermediaries and companies will be reporting on arrangements with certain characteristics, they should develop internal systems to identify arrangements that may require reporting.

Following are six highlights to keep in mind regarding the Directive.

DAC6 requires reporting as transactions occur

Under DAC6, reportable cross-border arrangements are not reported at the end of the year, but rather within 30 days of a specified date, specifically:

a. the day after the reportable cross-border arrangement is made available for implementation;

b. the day after the reportable cross-border arrangement is ready for implementation; or

c. when the first step in the implementation of the reportable cross-border arrangement has been made.

The 30-day reporting requirement is much shorter than comparable reporting regimes. For example, the US requires annual reporting of reportable transactions as an attachment to the taxpayer’s income tax return. DAC6 aims to provide tax authorities with a more current picture of a taxpayer’s activities through this condensed timeline.

DAC6 requires reporting a broader range of transactions

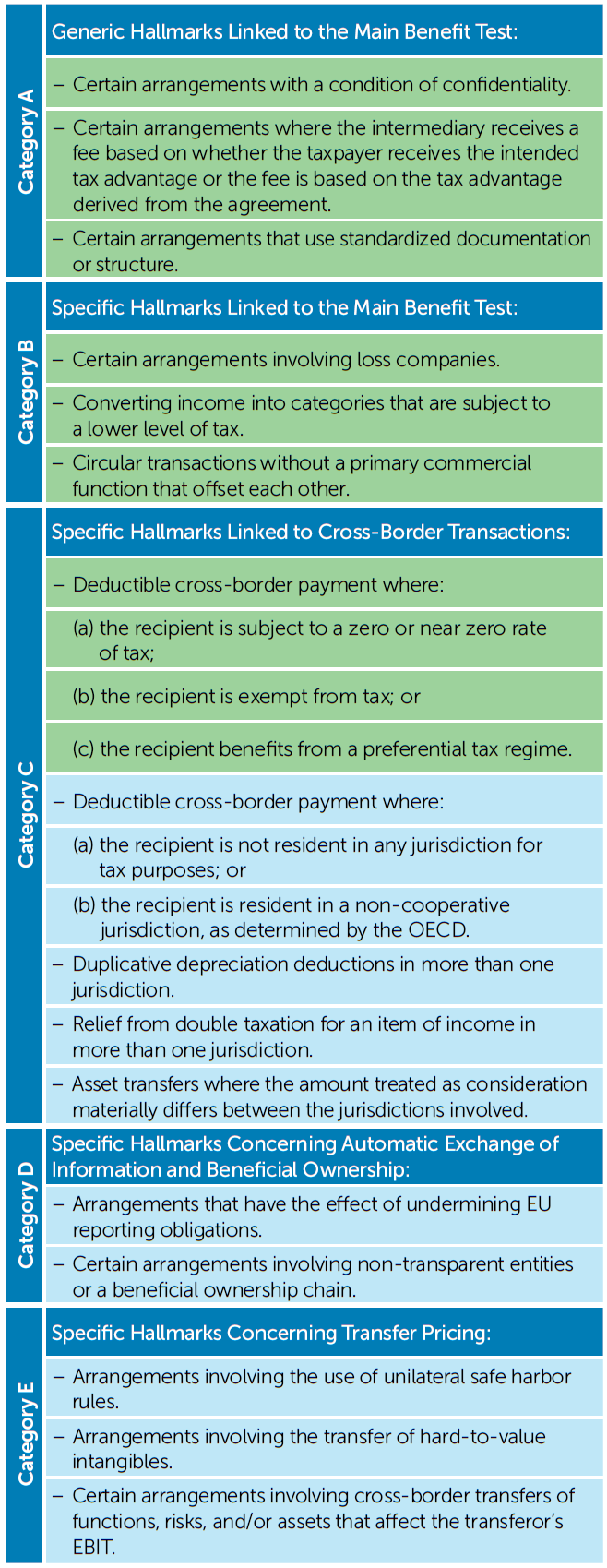

If a taxpayer engages in a cross-border arrangement, DAC6 requires reporting if the arrangement implicates one or more of the Directive’s reportable hallmarks. The Directive divides the hallmarks into five separate categories (Categories A through E). While some of these hallmarks are only reportable if one of the main benefits of the arrangement is to obtain a tax advantage (this requirement is termed the main benefit test), other hallmarks do not share this requirement so that some ordinary business transactions that would not be deemed to have a tax purpose may be subject to the reporting requirement. Moreover, no business or commercial exception is provided.

The table to the left provides additional information regarding the reportable hallmarks. The hallmarks in green do not by themselves require reporting unless the main benefit test is met. The hallmarks in light blue are reportable regardless of whether the main benefit test is met.

The US also requires similar transactions to be reported; for example: confidential transactions, transactions in which a taxpayer receives a refund if a tax benefit is not realized, and certain loss transactions, among others. The US regime targets transactions or restructurings that it has specifically identified as being tax abusive. In contrast, the reportable hallmarks of DAC6 are in some cases more generalized, requiring a broader range of transactions to be reported.

DAC6 may require reporting of transactions between non-EU Member States

DAC6 defines a cross-border arrangement as an arrangement concerning more than one Member State or both a Member State and a third country in which:

- not all of the participants are residents for tax purposes in the same jurisdiction;

- at least one of the participants is resident for tax purposes in multiple jurisdictions simultaneously;

- one or more of the participants carry on business in another jurisdiction through a permanent establishment (PE), and the arrangement forms part or all of the business of that PE;

- one or more of the participants carry on an activity in another jurisdiction without being a resident for tax purposes or creating a PE in that jurisdiction; or

- the arrangement has a possible impact on the automatic exchange of information or the identification of beneficial ownership.

The language of the Directive appears to be broad enough to take into account arrangements that may occur between non-EU Member States, but at some level, implicate Member States. For example, a transaction between companies in Switzerland and China that is funded by a German affiliate of one of the parties could fall within the definition of a cross-border arrangement. Thus, the steps leading up to an arrangement, as well as the arrangement itself, may determine whether the transaction is considered to be a cross-border arrangement.

DAC6 generally places the burden of reporting on intermediaries, rather than the taxpayer

If the arrangement is a cross-border arrangement that bears one or more of the Directive’s reportable hallmarks, all intermediaries must report certain information about the arrangement to the relevant EU tax authority, unless an intermediary has proof that the information has already been filed by another intermediary. An intermediary is anyone who designs, markets, organizes, or makes available for implementation or manages the implementation of the arrangement, such as bankers, advisors, and attorneys.

Unlike reporting requirements in the US, the taxpayer generally does not have a reporting requirement. However, the taxpayer is required to report arrangements that involve a non-EU intermediary, arrangements in which no intermediary is involved, and arrangements where the intermediary has the right to a waiver due to legal professional privilege.

The information required to be reported generally amounts to a description of the arrangement and the hallmark(s) that triggered the reporting requirement. If a cross-border arrangement is reportable, the intermediary or the taxpayer must provide general information about the taxpayer and the intermediaries involved in the arrangement (such as name, residence, and taxpayer identification number). The intermediary or taxpayer must also provide a summary of the arrangement, details of the applicable hallmarks, and the date the first step of the arrangement has been or will be implemented, among other information.

By placing the reporting requirement with intermediaries, the Directive removes control of the distribution of information from the taxpayer. Intermediaries must decide whether an arrangement is reportable and, if so, the level of detail to provide in connection with their reporting obligations. Since intermediaries would bear the penalty for failure to report, intermediaries may be encouraged to adopt a broad view of which transactions are required to be reported and disclose more information than the relevant taxpayer would have disclosed if it had reported the information itself.

Discretionary exception for legal or attorney-client privilege

Although the reporting requirement is generally imposed on an intermediary, when the intermediary is an attorney, the Directive permits a Member State to provide an exception for such a privilege that is protected under the law of the Member State. (Note that not all Member States provide a legal privilege for advisory advice and instead limit the privilege to litigation matters.) If a legal privilege applies, the attorney must inform any other involved intermediaries of the disclosure requirements, and if there are no other involved intermediaries, must inform the taxpayer of the disclosure requirement.

EU Member States may expand the scope of DAC6

As with other EU Directives, to become enforceable, Member States must each pass legislation to implement the Directive. The timeline for passing such legislation is December 31, 2019, with enforcement of the Directive to begin by July 1, 2020. The specific legislation implemented by a Member State, however, may broaden the scope of reportable transactions, broaden the scope of taxes covered, accelerate the first reporting deadline, or set penalties for failure to report. Poland’s implementing legislation, for example, requires domestic as well as cross-border arrangements to be reported.

Given the Member States’ discretion regarding the reporting deadlines, Member States may be encouraged to pass legislation requiring earlier reporting in order to access the information sooner. Poland’s implementing legislation, for instance, is effective January 1, 2019, instead of July 1, 2020, as required by the Directive.

DAC6 has retroactive effect

While Member States must pass implementing legislation by December 31, 2019, and begin enforcing the DAC6 by July 1, 2020, the Directive has a retroactive effect. Specifically, reportable transactions occurring between June 25, 2018, and June 30, 2020, must be reported by August 31, 2020. Any transactions occurring after June 30, 2020, must be reported within the 30-day period noted above. In other words, the Directive is currently effective even though implementing legislation will be passed at a future date.

Conclusion

DAC6 represents a major compliance obligation. The Directive requires transaction-by-transaction reporting within a short time frame of 30 days. Additionally, the Directive’s broad definition of cross-border arrangement allows it to cover steps leading up to the implementation of an arrangement.

In an important shift, the Directive generally places the reporting obligations on intermediaries, rather than the taxpayer. Thus, intermediaries must decide whether to report certain arrangements as well as the level of detail to report. Since the intermediaries also bear the penalties for failing to comply with the Directive, intermediaries may be more likely to report arrangements and report a high level of detail.

Given the Directive’s current effectiveness and retroactive reach, intermediaries and taxpayers should be aware of their reporting obligations and analyze whether any arrangements implemented since June 25, 2018, are reportable.