When the acquisition of The Athletic by The New York Times Company was announced in early January 2022, it capped the first time its CLO and General Counsel David Ortenberg had handled a merger as in-house counsel after working for private firms for most of his career. Ortenberg was the first in-house lawyer for The Athletic.

Coming from Gunderson Dettmer where Ortenberg had represented The Athletic as external counsel, going in-house was a “big change” and he had to build confidence as he approached the different perspective. And handling The New York Times deal from the inside was representative of the switch. It turned out to be “a perfect marriage.”

The US$550 million cash acquisition of the six-year-old new media venture by the 170-year-old media giant closed on February 1, 2022 — combining two companies that media analysts consider success stories in building subscription bases.

“The deal brings The Times, which has more than eight million total subscriptions, quickly closer to its goal of having 10 million subscriptions by 2025, while also offering its audience more in-depth coverage of the more than 200 professional teams in North America, Britain, and Europe that are closely followed by The Athletic’s journalists,” said Meredith Kopit Levien, chief executive of the New York Times Company, who, in their own coverage, called The Athletic “a great complement to the Times."

As of November 2021, The Athletic’s subscriptions numbered 1.2 million, per TechCrunch.

The Athletic is the second-largest US employer of sports journalists, with a newsroom of 400, behind ESPN, which is owned by Disney, per TechCrunch.

Ortenberg looks forward to staying on, as do the founders, Adam Hansmann and Alex Mather, who started The Athletic in 2016. Hansmann, its current president, will become chief operating officer and co-president, and Mather, its chief executive, will be general manager and co-president.

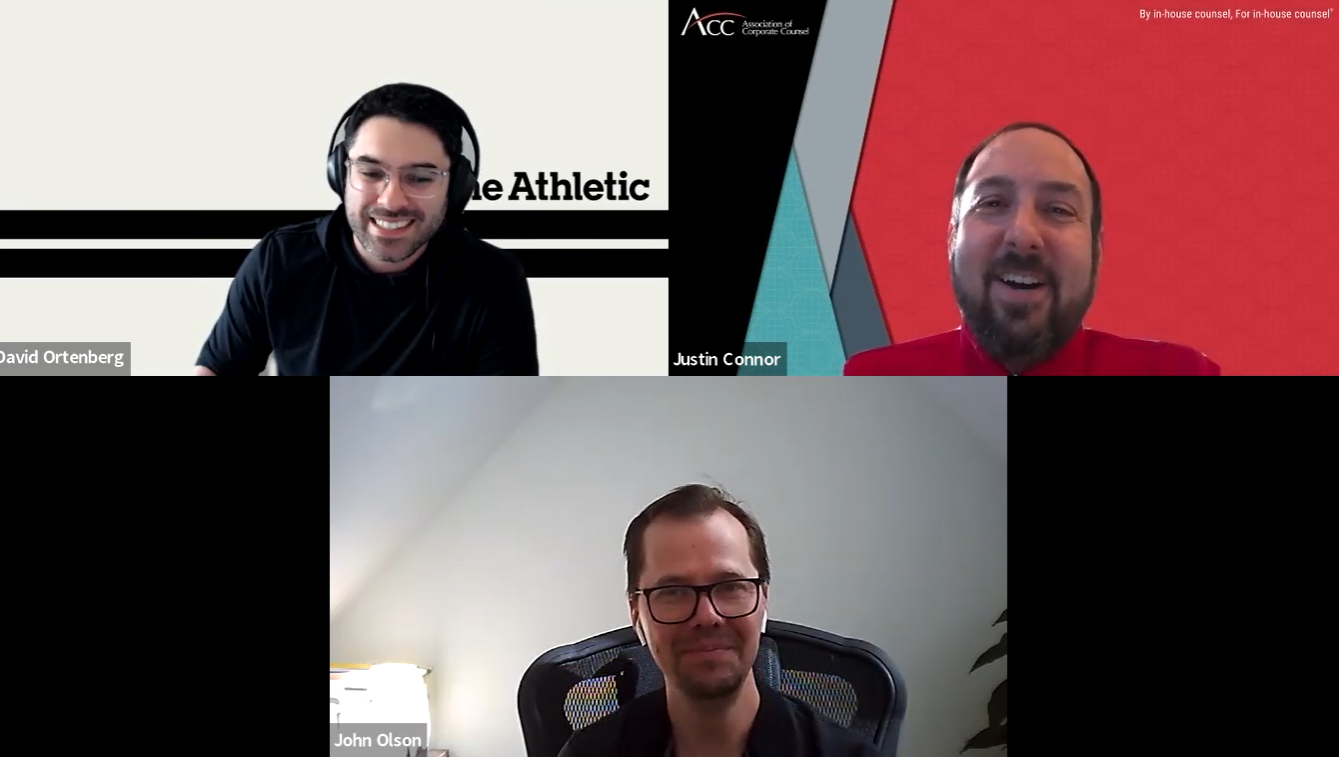

“We’re the best place on the internet where you can get in-depth sports coverage,” said Ortenberg in a video interview along with Gunderson partner and M&A specialist, John Olson, The Athletic's law firm, conducted by ACC’s Justin Connor, director of corporate membership and CLO engagement.

in a recent video interview by the ACC's Justin Connor.

The Athletic’s primary goal was to “re-invent what sports writing could be, to bring sports back to its roots.” Its launch became fortuitous. Their first market was Chicago and it covered the Cubs winning their first World Series in more than 100 years.

The company expanded to Toronto and Cleveland, and now covers almost every pro and college team in the United States and Canada, as well as 20 premier league teams in the United Kingdom. And they added a “huge” podcast channel, says Ortenberg, and have ramped up profiles and global sports news.

Also known for featuring some of the biggest names in sports journalism, including Ken Rosenthal, who covers major league baseball, David Aldridge and Shams Charania, who cover the NBA, Katie Strang, for investigative sports, and David Ornstein, who is “probably the biggest sports news breaker in the UK,” Ortenberg says. The Athletic is clearly a hot commodity.

So, what did Ortenberg and Olson learn that could help other in-house lawyers approaching or interested in mergers and acquisitions (M&A)?

Founders’ conundrum

ACC: John, you were critical in this transaction, obviously. You’re a partner at Gunderson, specializing in M&A, based in Silicon Valley. Tell us a bit about your perspective, about how the deal came together for The New York Times Company to acquire The Athletic. Why do you think it made sense at this particular moment?

John Olson: This obviously was a very exciting deal for The Athletic. It was also a very important deal for the Times.

In many ways it embodies one of the most common archetypes for any successful M&A deal coming out of Silicon Valley, which is that you have a startup, it’s led by a founding team, that founding team started with a fantastic idea, executed it, and built a real business.

And seeing tremendous growth of the business up to a point where it had really proven itself, not just as a viable business, not to just clear that bar, but to become an attractive growth opportunity as a strategic target for acquisition by a more mature business like The Times.

The choice to sell at any point for a founding team is always somewhat idiosyncratic. It’s always a question for the founders, and key managers and key stakeholders, as to whether or not they will better achieve their goals by continuing as a private company, on a stand-alone basis, or whether or not they want to take that business — that is often, frankly, their proverbial baby — and combine it with a larger organization that might help that business sail even further and achieve greater success.

From my perspective, not making those decisions myself, the deciding factors often seem to be emotional as much as financial. And, sometimes on the emotional side, the founding teams are not ready to give up control.

Other times, an acquisition can be a validation of the hard work — and vision and strategy — that they and all the other contributors gave to the success of the business.

The key drivers of the deal

ACC: David, of course, you were on the inside. You’ve been there several years as GC of the company and have really grown with it. Tell us about your perspective on the buyer and seller here. What do you see as the key drivers of the deal and how it re-shapes the media landscape going forward?

David Ortenberg: We really felt at the end of the day that this was a perfect marriage. We’ve always admired The New York Times. We’ve learned a lot from them and followed the things they’ve done as really the leader in subscription, which is something that we brought to sports media.

We’ve learned a lot from them and followed the things they’ve done as really the leader in subscription, which is something that we brought to sports media.

And then, through this deal, we got a chance to really get to know them and sort of see how their brains work. It really became a dream come true for us to join together.

We really think this gives us the opportunity to do what we do best, which is sports journalism, at an institution that is committed to journalism.

We get to continue along the path we were on before the acquisition with a great partner and, for us and for The Times, I think it’s an opportunity to add the incredible bundle of subscriptions that The Times offers. To be a part of The Times, to be a part of that larger universe, is really exciting for us.

Getting a dream job

ACC: Speaking of dreams, I think, David, a lot of people might say you have a dream job. You kind of live at the intersection of the internet, the sports, journalism, all of these interesting issues. Tell our readers a little bit about how you got this job and how you became GC at The Athletic.

Ortenberg: Like everything, it’s a combination of luck and design. I started my career doing international M&A, much like John is now, and decided that wasn’t what I wanted to do with my life after about five years of doing it. I really wanted the chance to work with founders to really understand the meat of business, which is why I had joined Gunderson. And when I got to Gunderson, I heard that The Athletic was a client. As a huge sports fan, I was already reading The Athletic at the time that I started at Gunderson.

I went into the partner’s office who handled the relationship and asked if I could join the team. I begged and I pleaded to be a part of the team. I got lucky that the associate who was sort of managing the day to day on that account was looking for a new challenge.

There was never going to be another opportunity for me to do something that combined my interest in sports, my interest in media, my interest in journalism, with a client and a team that I felt really great about.

I got onto The Athletic team and I started working as outside counsel for about a year. I got to know their business really well, got to understand the issues. When the opportunity to join them as the first legal hire came, I couldn’t pass that up. There was never going to be another opportunity for me to do something that combined my interest in sports, my interest in media, my interest in journalism, with a client and a team that I felt really great about. I couldn’t have scripted it any better for myself.

Approaching an M&A with the right negotiating style

ACC: And John, you work with a lot of startups every day and you help them do M&A deals. Every deal is different. Tell us a bit about some of the unique twists and turns to kind of make this deal happen. And, at the same time, were there any learnings that you think in-house counsel might be interested in and to take away from the transaction?

Olson: Three things come to mind:

- Doing deals in the media space,

- Thinking about preparation for M&A, and

- Thinking about negotiating style.

Taking them in order, doing a deal in media is challenging in part because media likes to pay attention to deals that are done in media. And so, journalists are very interested and, frankly, the public is very interested because it’s a consumer-facing business. Because of that tremendous interest from the public, doing a transaction with that amount of focus means that extra care has to be taken to make sure that everything is done right because, in essence, your audience and your stakeholders are not just the people in the negotiating room … it’s actually the broader public as well.

The second piece I would focus on is more broadly applicable to any business — preparation. One of the things with M&A is it’s always a super-intense process. And it can be particularly intense for a startup that might not have been as focused on being organized and having super-robust compliance who, once they get into the process, they might realize that they might not have been ready for it.

And one of the really great things that distinguished this deal from many other deals I’ve done is how prepared David and his team were relative to so many other teams. I chalk that up to, perhaps, David’s prior experience as an M&A lawyer. He knew what the questions were going to be and was always making sure he was going to answer those. So, I think that’s a critical point.

And then the last point I’d touch on is negotiating style. There’s an unfortunate tendency among some M&A practitioners to approach a deal as a war of attrition and, thankfully, here, in this transaction, we had very practical counterparts. They were very focused, like we were, on getting a deal done, not chasing theoretical “wins” on an imaginary playing field that only lawyers care about. And to use the classic sports metaphor, both sets of lawyers are trying to start at the 30-yard line and not at the 5-yard line to get to the middle efficiently.

In-house lawyers should consider encouraging their business teams to get on board with that approach because we found it to be a much better way to get to a deal.

Transitioning from firm to in-house counsel

ACC: David, you were the first in-house lawyer hired at The Athletic. What was that transition like for you from having been in private practice for several years before doing M&A deals and then, all of a sudden, being the generalist, and having to advise on a whole bunch of different issues? How did you manage workload and how did you manage that transition?

Ortenberg: It was a big change. And going forward, I don’t think I appreciated how big a change it was moving over from the firm side to in-house.

You just have to approach and appreciate that you’re going to have challenges and you’re going to have things that you’ve never seen before. You have to be open and willing to learn new things, learn from other people, and explore challenges and changes that you hadn’t expected. Be ready and open to deal with a lot of new issues that you never have seen before is probably the right mindset.

Be ready and open to deal with a lot of new issues that you never have seen before

is probably the right mindset.

The other piece that was a huge adjustment for me, is being prepared to make decisions in a way that I don’t think you have to do when you work in a law firm, especially if you’re an associate at a law firm where you have a client, or you have a partner who will, ultimately, give advice, who can say, “This is how I approach it.”

There’s some of that when you’re in-house — you present options to your business team and then you make the final call. But there are many more times where you’re the decider, you’re the one who has to say, “This is the approach I want to take, this is how we’re going to keep going, this is the law firm we’re going to use.”

But there are many more times where you’re the decider, you’re the one who has to say, “This is the approach I want to take, this is how we’re going to keep going, this is the law firm we’re going to use."

And so, just being ready, or willing, to step up to the plate and say, “OK, I can make decisions. I am confident in myself, in my own judgment … to make those day-to-day decisions,” which, again, was a much bigger change than I expected jumping over from a law firm.

It’s still a founders’ market

ACC: John, tell us a little bit about what you’re seeing in the marketplace. Obviously, a lot of founders are doing exits all the time in what may be considered a “frothy" market in certain ways. How is the market affecting the balance of power between the startup founders and the investors chasing returns? And how do you see that as impacting the founders’ decisions as to when to sell?

Olson: In this environment, the founders, when they have a growing and interesting business, are still very much in the driver’s seat. Funding opportunities for good and growing businesses are plentiful in private markets, as well as public markets, and the M&A market. It’s ultimately up to the founders as to whether or not they want to pursue an M&A exit or they continue down the private path.

Funding opportunities for good and growing businesses are plentiful in private markets,

as well as public markets, and the M&A market.

I think that investors can nudge them one way or the other and provide very helpful advice but it’s obviously up to the founders. That presupposes that the business is still growing and isn’t running into funding challenges. If the business has matured and is experiencing slower growth or is not able to find readily available funding, then that’s a different story. In that scenario, an investor might actually be able to lean more heavily on a founder to pursue an exit. But, in my experience, it’s still the founders that are really making the decision on a good exit.

ACC: David, what do you see as next after the acquisition? Do you foresee staying with the business, helping it grow, and integrating it into The New York Times Company or do you want to move to the next startup? Do you have startup fever?

Ortenberg: There’s still a lot to do at The Athletic. We are remaining a subsidiary of The New York Times although there’s lots of new connective tissue we’re learning to build and communication lines we’re still establishing. Since we finalized negotiations for the deal early in January, I’ve been heads down working on integration and thinking through how to make sure that this deal is a success for everybody involved. … So, I’m really focused on that and am excited to help this team grow and help The Athletic continue to perform on our expectations and our dreams.

ACC: John, given the client base you represent and how you work with them, what do you see as the greatest challenges today facing digital media companies similar to The Athletic and, by extension, how does that impact the in-house legal teams that work in those businesses day-to-day?

Olson: The biggest challenges for digital media companies that I see are being nimble and being able to experiment with new business models and take risks in the marketplace that distinguish themselves. One of the biggest challenges is that, with digital media platforms, there’s a lot of competition out there. And there’s a lot of innovation. To find the right business model, it takes thought, it takes strategy, it takes execution, but it also takes flexibility, and willingness to experiment. And, of course, if the business is experimenting, then that means, by extension, the legal teams are going to have to roll with that and to be always — constantly — willing to learn more as the companies pivot in different ways.

... If the business is experimenting, then that means, by extension, the legal teams are going to have to roll with that and to be always — constantly — willing to learn more as the companies pivot in different ways.

Avoid analysis paralysis

ACC: David, in your first year heading the legal function at The Athletic, what did you find surprised you most? How did you pivot to manage that surprise or respond to it?

David: You can end up with analysis paralysis. You think through all the different options or things that could happen. As a lawyer, especially as a firm lawyer, you’re always trained to always orient toward the worst-case scenario and you can’t really do that when you’re working in-house.

As a lawyer, especially as a firm lawyer, you’re always trained to always orient toward the worst-case scenario and you can’t really do that when you’re working in-house.

And so, from a pivot perspective, for me, it just was about getting reps, it was just about, hey, I made a choice, the world didn’t burn down, maybe it ended up being the right choice, maybe it ended up being the wrong choice. … It was just having that constant reinforcement — at least to myself.

… And then you get to a point where it’s, even if this isn’t ideal, this isn’t the perfect decision, we can figure it out moving forward, we can always adapt, we can always change, we can always fix those mistakes we are making.

It was really just a change of mindset to keep the business moving, be flexible, be nimble, and always be looking for the best answer at the moment, and be willing to change that answer if the facts change. … And the pace is very different … than when you’re providing outside counsel.

ACC: John, if you had to leave us with one key takeaway for in-house counsel in leading their organization in a transformative transaction like The Athletic-New York Times acquisition, what would that takeaway be?

Olson: Understanding that M&A will always be intense, but it doesn’t need to be overwhelming. You can take a deep breath, pace yourself, work with people you trust and, ideally, do some preparation ahead of time, make your life easier for when you go through that intense period.

... M&A will always be intense,

but it doesn’t need to be overwhelming.

ACC: And, similarly, David, about your first few years in the role of GC at The Athletic — if you could go back to that first year, maybe give yourself some advice or say I would do this differently, what do you think you might say to yourself in starting a new in-house role?

Ortenberg: What I would probably say to three-years-ago me is, “It’s okay to not know all the answers. You’re going to learn a bunch, you’re going to see things you never tackled, you’re going to have opportunities or challenges right in front of you that maybe you didn’t expect.”

We launched in the UK — and I joined in Fall 2018 — and we launched in sort of a whirlwind fashion in August 2019; I didn’t think I was ever going to have to know as much about UK corporate law as I do now to get that function off the ground. You can’t prepare for what’s going to happen at a business but just take a deep breath, as John said, and enjoy the ride and trust that you’ll be able to figure out anything that gets thrown at you.

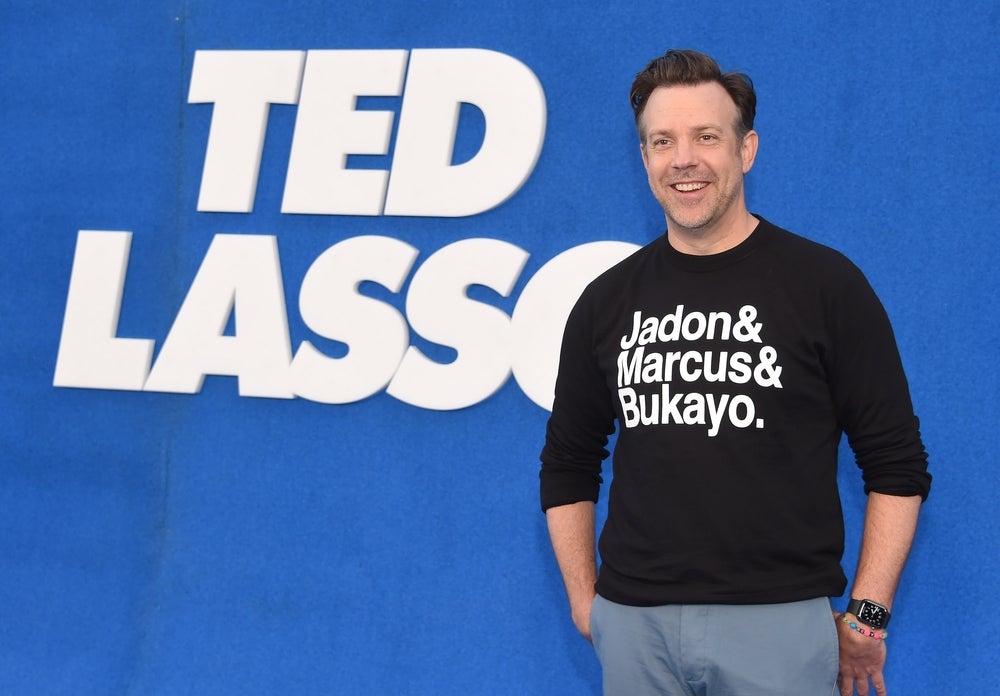

ACC: Maybe just channel your inner Ted Lasso!

Ortenberg: Exactly!

ACC: Maybe get your own sports psychologist!

Ortenberg: Yeah, something like that!