Banner artwork by Stokkete / Shutterstock.com

Cheat Sheet:

- Right-size your program. Target your program maturity based on your requirements and risks, avoiding over designing and overspending or creating an immature program that is not compliant.

- Own your retention schedule instead of renting. Creating your own schedule provides greater alignment to your business, greater employee investment in compliance and avoids ongoing subscription fees.

- Leverage existing tools and synergies. Use technology you already have such as M365 to publish and enforce retention policies.

- Automate disposition of electronic information and reduce offsite paper record storage. Set up automated record disposition and cut down offsite paper records storage to save money and minimize risk.

In today’s environment, in-house legal, compliance, and privacy teams face intense pressure to do more with less. Budgets are tighter even as data volumes explode and regulations like privacy laws and industry-specific rules demand strict recordkeeping. Storing mountains of data indefinitely “just because” is no longer viable — it drives up costs and legal risks. At the same time, poorly managed records can lead to compliance violations or costly eDiscovery ordeals.

The challenge for in-house counsel is clear: reduce records management costs while staying compliant and efficient. Fortunately, a smart records management program can achieve both goals. By focusing on practical, cost-conscious strategies, companies can streamline how they manage information, eliminate wasteful practices, and still meet all legal obligations. The following 12 strategies offer actionable ways to run a leaner, more cost-effective records management program without sacrificing compliance or productivity.

1. Choose the right program maturity (don’t over-engineer)

It’s tempting to aim for developing a records management or information governance program with every possible bell and whistle — especially if you’ve seen complex frameworks or high scores on maturity models. But over-engineering your program can burn through budget, and actually slow program adoption. A smarter approach is to choose the right level of program maturity for your organization’s size, compliance requirements, litigation profile, jurisdictions you operate in, business needs and company culture. In other words, don’t over-engineer a solution that is far more elaborate (and costly) than necessary to stay compliant. Instead of attempting to develop a “Cadillac” level program, often a good “Chevy” will do. Proactively and consciously determine the right maturity for different program elements and build it to those levels.

2. Avoid spinning your wheels creating an enterprise data map

Some data mapping exercises, such as mapping where personal information flows through the enterprise or understanding where relevant information under legal hold, are useful or necessary. But while creating a comprehensive map of all enterprise data that details what data lives where sounds useful, it can become a giant time and money sink that can drag on for years. Even when completed, enterprise data maps quickly become outdated. Furthermore, it quickly becomes apparent that much of the data is either expired and should be deleted or lives in the wrong place. Instead of detailing your current immature current state, this energy is often better spent improving where information should live and how it can be managed and deleted.

Instead of attempting to develop a “Cadillac” level program, often a good “Chevy” will do.

3. Don’t rent your records retention schedule, own it

One immediate way to cut costs is to stop “renting” your records retention schedule from outside vendors and instead create your own customized schedule that meets your specific needs. While it may be tempting to use “off the shelf” records management products available via a subscription, the one-size-fits-all templates of these schedules can miss many company-specific records. And while these products appear to be an easier way to get started, they lock you into ongoing subscription fees for a potentially long time. Better to have a bespoke schedule based on the actual records in your environment. If you “own” your schedule you not only don’t pay the ongoing fees, but you are also free to update and apply the schedule as needed. Over the long run, this can save tens of thousands of dollars.

4. Avoid double-paying for legal research

Another hidden cost of off-the-shelf records schedules is paying twice for the same legal research. To ensure compliance, recordkeeping requirements need to be validated against legal and regulatory requirements. We have found that even expensive off-the-shelf recordkeeping products often misclassify requirements, and this misclassification can drive over retention (see box). We have also seen instances where they miss requirements entirely. This drives many companies to pay an outside law firm to review their schedule for legal correctness.

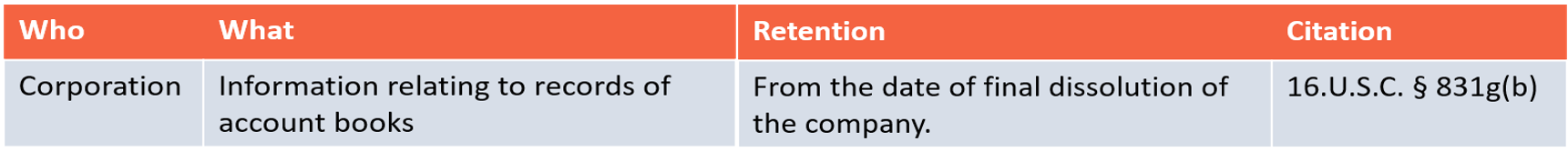

Case Study: Misapplying Record Retention Rules

Record retention legal and regulatory citations need to be validated to ensure they are applied correctly. The following is a US Code of Federal Regulation citation from a popular records research product:

Unfortunately, this requirement does not, as the product suggests, actually apply to corporations. Rather, review of the actual text from the citation reveals that it applies to the above rule applies to “the corporation,” specifically the Tennessee Valley Authority Corporation. In other words, while it’s a valid retention requirement, it only applies to a single entity. Mistakenly including this requirement could drive significant over-retention of information.

A qualified consultant will be able to both research and correctly apply legal and regulatory requirements. Likewise, a well-research schedule should not require review by an outside law firm. Pay once and get it right.

5. Create a modern schedule that is easier to execute

Creating or updating a records schedule is often the first step of the process. More than 90 percent of the effort and expense of a program is executing the schedule against both paper and especially electronic information. Many of these older schedules also use obscure legal language and outdated media references — e.g., assuming email is a record type when it is simply a medium that contains both records and non-records — which can confuse employees.

It’s a mistake to assume that a lengthy, detailed schedule with more than 150 record categories makes a program more compliant. Compliance and defensibility come from not only correctly identifying requirements, but perhaps more importantly execution of the schedule consistently across the enterprise.

A key strategy for saving money is to simplify and modernize your retention schedule so that it’s easy to implement. Do invest in developing a modern, workable schedule that addresses both legal and regulatory requirements and business needs. This will pay cost-saving dividends throughout the life of the program.

Attributes of a Modern, Easier-to-execute Schedule

- Includes a comprehensive list of record types across all media.

- Captures both typical and company-specific records.

- Records accurately identified based on validated legal and regulatory requirements.

- Records identified by business value. Drives a consensus across key stakeholders and business units on what to save for how long and what can be deleted.

- Addresses maximum length and legitimate business need for retaining personal information.

- “Bigger bucket” record categories.

- Avoids legalese, esoteric acronyms or jargon. Is clear, plainspoken and informative.

6. Use M365 to publish the schedule

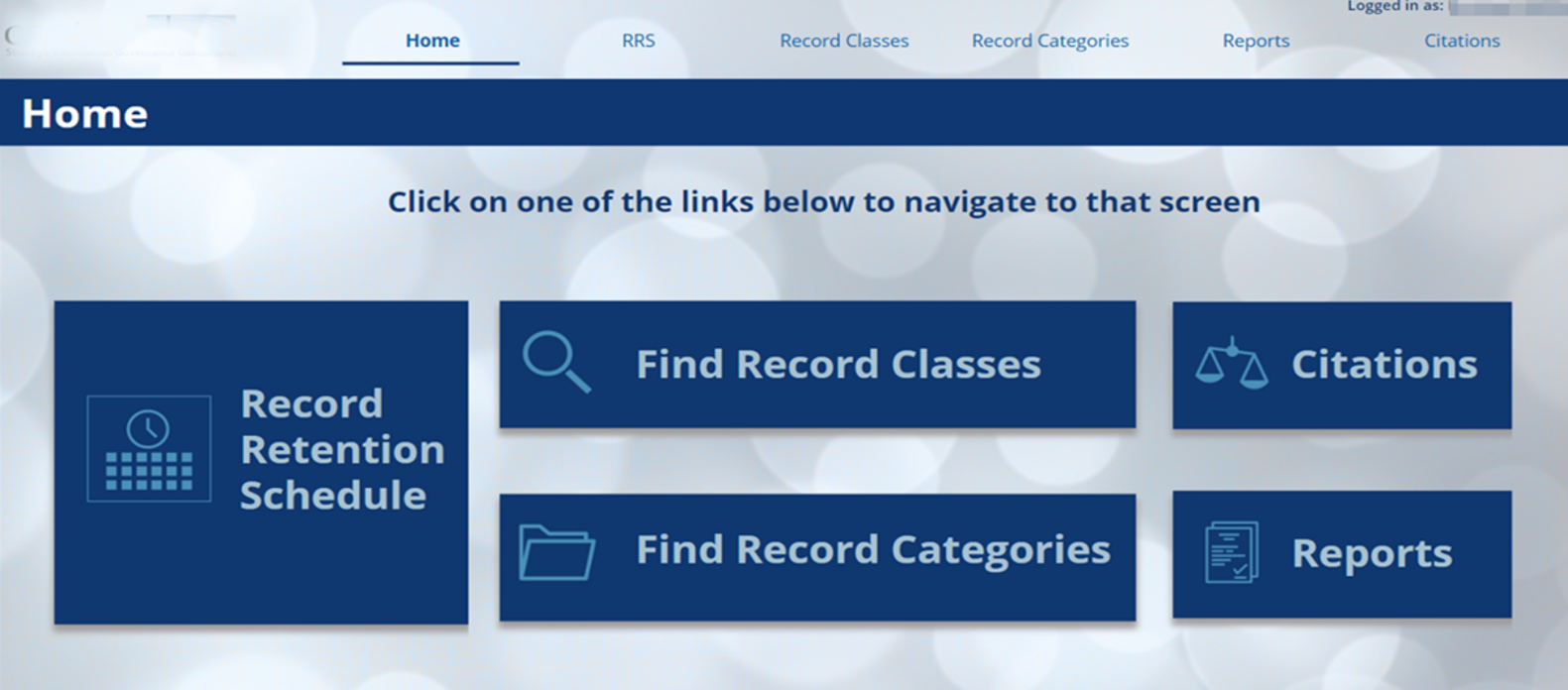

You don’t necessarily need a fancy new product to publish and share your records retention schedule. One cost-effective strategy is to use technology and tools your organization already has in place to disseminate the schedule and related policies. Many companies, for instance, use Microsoft 365 SharePoint to manage and publish their schedule. Standard SharePoint can be configured to provide employee access to a schedule via browser with department-specific or even country-specific customized views. It can even track and log changes.

Figure 1. An example of a records portal configured with M365. This is a configuration of the base version of M365 and not an add-on product.

7. Use M365 for managing records

Companies often think they need to buy expensive new enterprise content management or document management systems to manage files, emails, and other information. It turns out that the basic E3 version of M365 is also fully capable of not only managing records but automating many records management functions. Google Docs also has some records management capabilities.

8. Merge records management and privacy efforts

Privacy regulations (like the EU’s GDPR, California’s CCPA, and others worldwide) have put new demands on organizations to manage personal data carefully — including deleting data once it is no longer needed for the original purpose for which it was collected. Privacy program needs and activities overlap significantly with records retention policies. Merging your records management and privacy compliance efforts is a smart way to save money and work more efficiently. Rather than having separate teams or processes for “records cleanup” and “privacy data deletion,” it makes sense to coordinate them since both ultimately involve managing the lifecycle of information.

9. Automate the disposition of records

Too often records disposition stalls out because it depends on employees manually selecting expired electronic records for disposition. Manually managing the disposition can be labor-intensive and if inconsistently applied creates compliance and legal hold risks. A better approach is to enable automatic disposition of electronic information. This means setting up systems so that when a record reaches the end of its retention period, it is automatically deleted or archived without someone having to intervene each time. Automation can apply to both electronic and physical records (with some help from vendors for the physical part). Automation reduces labor hours spent on routine work and minimizes human error, both of which save money.

10. Don’t let deletion review processes bottleneck cleanup

As much as they complain about the problems created by information over retention, sometimes legal departments are part of the problem. Fearing deletion may run afoul of legal holds or simply lack of faith that records have not been properly classified, some legal departments set up an information deletion review process. The problem is that reviewing thousands or even tens of thousands of files to be deleted creates a bottleneck, and ongoing deletion falters. Better to attack the root of the problem and create defensible and documented legal hold processes (using M365). Audit records classification processes and remediate as necessary. Then, trust your processes. They may not be perfect and that’s OK. The courts and regulators are not expecting perfection, rather reasonable, good-faith efforts.

11. Use departmental records coordinators

One proven way to run a cost-effective records program is to distribute the workload by enlisting departmental records coordinators. Instead of a central records manager trying to single-handedly manage all records company-wide (or having to hire a large team), identify a records coordinator point person in each department or business unit who helps train, implement and evangelize records policies locally. They typically do this part-time, alongside their regular job, but with special training and responsibility for records in their area.

The courts and regulators are not expecting perfection, rather reasonable, good-faith efforts.

12. Attack record storage costs

Offsite records storage is the black hole of records retention costs, pulling in larger and larger expense amounts. Records storage vendors have made it very easy and convenient to add new records into storage, and very expensive and difficult to delete or remove record boxes from storage. Worse, most of the paper records in storage are simply copies of already-stored electronic information. Offsite record storage expenses deserve an all-out attack.

First, stop adding new paper records into storage. Implement processes and procedures to retain records electronically. Train your employees that printed information is a convenience copy, but the electronic repository is the official and compliant system of record. No need to send paper copies off to storage. The next step is consolidating and renegotiating agreements. Record storage vendors have grown through consolidation. It is not unusual for companies to have multiple, separate agreements for different locations with different processes. Be sure to audit your invoices. We often find a number of billing errors representing real money. It’s reasonable to push for the removal of “hostage” fee charges for getting rid of older boxes. Finally, do a full inventory of boxes under storage to determine content eligible for destruction. Addressing the offsite record storage is a bit of a process but offers real opportunities for cost savings.

Reduce costs while maintaining compliance

Running a smart, cost-effective records management program is entirely achievable with the right approach. The strategies outlined above show that by taking ownership, simplifying processes, leveraging what you have, and staying proactive, in-house counsel can significantly reduce costs while still maintaining full compliance and efficiency. The benefits go beyond just the P&L statement: A lean records program is also a stronger program — it’s easier to follow, less prone to error, and better aligned with business needs. In an era of tight budgets and heavy compliance demands, doing more with less is the name of the game.

Disclaimer: The information in any resource in this website should not be construed as legal advice or as a legal opinion on specific facts, and should not be considered representing the views of its authors, its sponsors, and/or ACC. These resources are not intended as a definitive statement on the subject addressed. Rather, they are intended to serve as a tool providing practical guidance and references for the busy in-house practitioner and other readers.